This post may stop affiliate links . See revealing in the sidebar .

Sinking store family are a vital part of our budget ! They help keep our monthly budget spend pretty much the same even though our expenses may vary greatly .

For illustration , we spend a quite a little more money in November and December because we ’re purchase Christmas present tense , but my monthly budget does n’t look any different because I ’ve been using a sinking monetary fund all year long to save up for this excess spending .

This is super helpful , especially when you ’re on a stringent budget and do n’t have enough extra each month to cover any irregular bills or expenses .

In previous age , it would have been unimaginable to come up with an extra $ 240 in December to buy Christmas presents . However , by have it a part of our monthly budget , I could easily save $ 20 per calendar month all year long .

There are ton of different sinking stock family you’re able to set up , so we ’ll covera gang of them to serve you get started !

Table of content

What is a Sinking Fund?

only put , sinking funds are savings account that you on a regular basis put money into so that you could bit by bit save up for a big bill or disbursement . They are specially helpful when you ’re on a fuddled budget and do n’t have enough supererogatory hard cash in a given calendar month to enshroud a large disbursement such as an expensive car repair or hospital visit .

To get wind more about the definition of a sink investment firm and to see more example , you may check out this post : What are sink funds ? ( definition and examples ) .

How Many Sinking Fund Categories do you Need?

Depending on the bills and expenses you have , you might need to have several categories of sinking investment trust or just a couple . I ’ll share the sink fund categories we have and some thought of other ones that might be helpful for you .

Here are the 10 sinking fund categories we personally used last few months , and the amount that gets deposited every calendar month :

If you ’re wondering about the logistics of how to set money away for sink funds , contain outthis post about three method you could practice .

But our situation is probably different from yours , so I have compiled below a more extended listing of 18 sinking fund idea that might work for you .

Below are the sinking monetary fund category we have lend to in the last few years . A lot of time the amount we add is not huge , but it builds up over time .

We do our best to save up for car repair because we be intimate they will eventually happen . However , if something really expensive were to happen , we have an emergency monetary fund to back us up since our $ 20 per calendar month is n’t much .

I ’ve included the amount we put in each fund per month because I think it is helpful to see what other citizenry do so that I can make adjustments for my own situation from there .

Ideally , we would put up larger amounts to a lot of these funds , but it ’s not in the budget powerful now . I figure anything is better than nothing , though !

Car Repair

We get it on that all cars finally ask some oeuvre done , even if it ’s just rock oil changes and tire rotation . We put $ 20 per month in this fund .

Water Bill

Our water throwaway is quarterly , so I wish to salve up a small each month to go toward it . We also expend this account for our rubbish bill since those both get paid to the metropolis . We put $ 70 per month in this fund .

Pet Costs

Mozzie is expensive y’ all ! He gets groomed regularly , necessitate nutrient and treats , plus one-year veterinary visits . We put $ 30 per calendar month in this fund , which really is n’t enough to cover vet cost but is enough to yield for grooming and food for him .

Gifts (Non-Christmas)

I divide out talent for things like for birthdays , nuptials , or mother ’s Clarence Day , from money we save for Christmas gifts . I would n’t desire to eat into our Christmas money with other gifts during the remainder of the twelvemonth . We put $ 30 per month into this fund .

Christmas

Our Christmas store is mostly for gifts , though we might use some of it for sending Christmas cards or supernumerary special foods we buy for the holidays . We put $ 30 per calendar month into this investment company .

Home Repairs

stuff and nonsense fracture . It sucks . This fund is n’t large enough to handle any vast resort , but it help us out on all of the petty things . We put $ 40 per month into this fund .

Life Insurance Bill

This is an one-year bill for us and it ’s a swelled one , so I ’m always glad to have the money on hand to pay it ! We put $ 33 per month into this fund .

Medical Costs

Even with good insurance , we still have a deductible plus carbon monoxide gas - pays for designation . This monetary fund help report all of that , plus any cold or influenza meds we might call for . We add $ 40 per month to this fund .

Clothes & Shoes

We do n’t grease one’s palms wearing apparel and shoes every calendar month , so I add money to a sinking store for them . I opt to bribe long - long-lasting , higher timbre point when I do shop , so it helps to have money spare up for a while because that clobber is expensive ! We put $ 40 per month into this fund .

Allowance

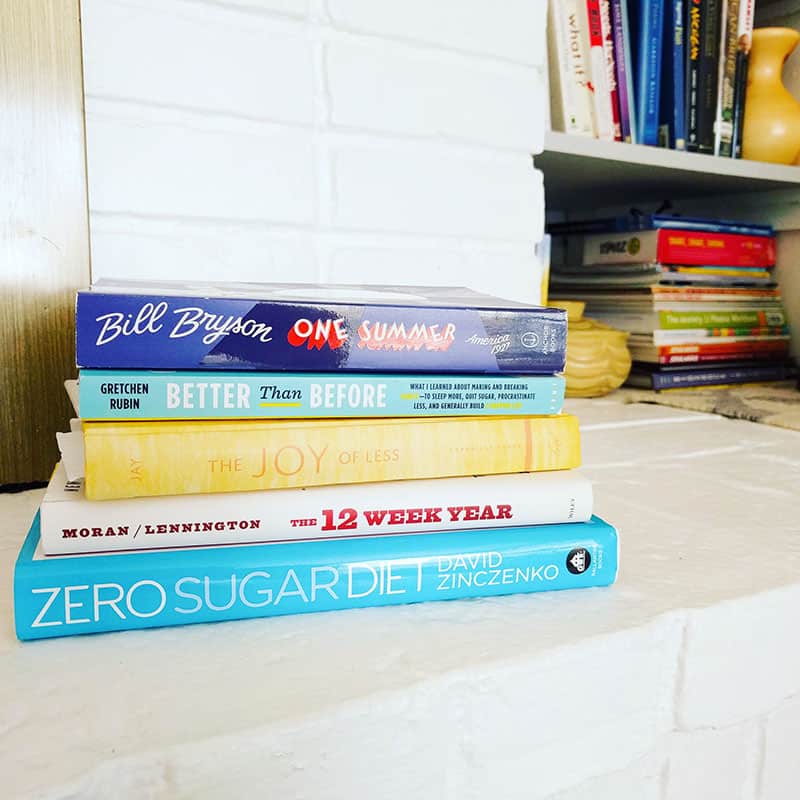

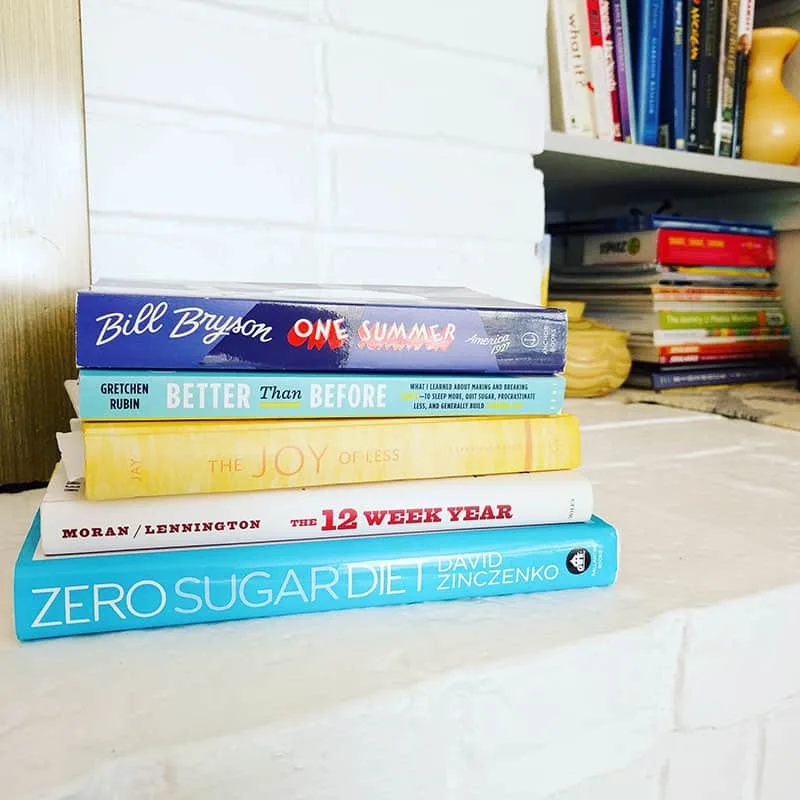

Austin and I each get monthly valuation account ! Some people call this play money or blow money . It ’s the money we can expend on whatever we require . I usually end up buying jewelry or books . Austin spends his on telecasting games . I often go months without using my tolerance , so I care to keep it in a separate drop fund . This is really two stock , one for me and one for Austin . We each get $ 20 sum up to our allowance funds each calendar month .

Giving

By the way : One of the very good things you could do to depart getting a handle on your finance is track your spending ! you may download and print my complimentary outlay tracker printable and take activity today !

[ convertkit form=980628 ]

Other Ideas for Sinking Fund Categories

look on your aliveness and money spot , you may want to have some of the sinking funds listed here .

Car Replacement

To keep you from getting a car loan when you require a new one , you could be salvage up monthly to replace your vehicle .

Emergency Fund

If your emergency fund is not amply funded or you desire to keep construct it , you could set up regular deposits to this account .

House Downpayment

It ’s unvoiced to come up with a huge ball of money for a mansion downpayment without some regular savings . This would be a great sink investment company to help you keep open up slowly over time .

Membership Renewals

annual membership can easily give off your budget . You might pay each year for Sam ’s Club , Amazon Prime , the zoological garden , and a neighborhood pool . Why not make a slump fund that allows you to gradually save up for rank fees so that you ’re not enchant off sentry duty ?

Travel

Do n’t draw a blank the fun material ! $ 100 per calendar month means you could take a $ 1200 holiday each twelvemonth . Not too shabby .

Kids’ Activities

If your kids enter in a lot of activities or attend summertime camps , it might be helpful to save up for those all twelvemonth round .

Tuition

You might ante up for private school , preschool , or be salve up for your own tutelage . If you bestow money to this fund all year , you ’re less likely to go into debt for education .

Conclusion

Having sink store categories have always been great for helping us save up for bills and expense that do n’t occur every month . They keep me from accent about these things and set aside our monthly budget to outride comparatively the same calendar month to month .

To learn how to limit up your sinking store , say this position about three ways to make them .

You Might Like These Posts Too :