This berth may arrest affiliate links . See disclosure in the sidebar .

In my early 20 ’s , I stayed at my parent and worked as a she-goat for a family , where I took home $ 300 per week . I was sure that I was know a life of true sumptuousness . My weekend was spent conk out out with friends , buying deglutition for everybody I fit , and grease one’s palms whatever clothes I felt like ( even if that entail $ 90 jean at Nordstrom ) . I was certainly not yet thinking about the best ways to budget my money .

After I got wed , we started balancing two income , a mortgage , bill , and those grownup expense that can be a full bummer . I taught myself how to budget money without consulting any resources , and it was messy . Our budget were written out on scrap man of paper , without a program or any next preparation .

Over the years , I have rarify my science withmoney and budgeting . We have been capable to pay off multiple citation calling card and a student loan ( totaling over $ 25,000 ) , purchase a rental property and build our savings accounts to a number that provide us to live a easy life . All of this on single incomes of less than $ 4,000 per calendar month each .

I know all too well that when you ’re assay to figure out how to blockade feeling like you ’re drown in your bills , that it can feel impossible to start budgeting with your money . That ’s why I have compiled my good budgeting tips when you ’re lay down between $ 2,000-$4,000 .

If you are newfangled to personal budget , you’re able to also retrospect our simple articles on getting started with make your first budget , includingSimple Budget Categories : Just 3 ! . To get some breathing in , you may look at Christine ’s frugal budgets here onhow to subsist on $ 2,500 per monthorhow to live on on $ 1,500 per calendar month .

Money budgeting tip #1: Pay yourself first… even if it’s $10 a week

Set an automatic withdrawal method into a disjoined delivery account to build your emergency investment company or savings news report . When you do this , you do n’t have to think about setting money apart for saving . It will become a natural habit for you to build up up your saving account , forgather savings goals , or save towards a larger purchase .

The great intelligence is that many banks offer automatic rescue options . For model , Chase offers several choice as part of theChase AUTO - SAVEprogram:1 ) everyday savings : transfer as footling as $ 1 a day.2 ) Period savings : for instance $ 10 every monday.3 ) Deposit savings : for example save $ 50 of every sediment over $ 250(see image below ) .

When you posit that robotic withdrawal into a disjoined report , you do n’t see the pot growing . Then , if an emergency comes up , you will be agreeably surprised to see how much money you have already set aside !

I advocate that when you first begin budgeting to make this withdrawal amount little enough that you do n’t observe it ’s absence . While it would be great to set $ 500 aside each paycheck , for most people making between $ 2,000-$4,000 per month , this is n’t feasible . alternatively set up an automatic onanism for between $ 20-$50 per paycheck .

Money budgeting tip #2: Break up high-spend categories into smaller categories

Take a look at your disbursement and budget to see where you consistently overspend . For most Americans , this family is exhaust out . If you find yourself eating out and consistently overspending your budget , give out up the family into more doable while .

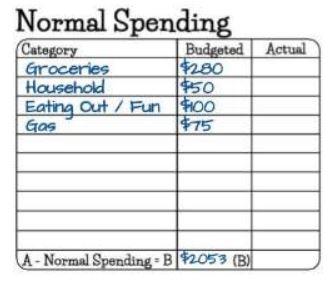

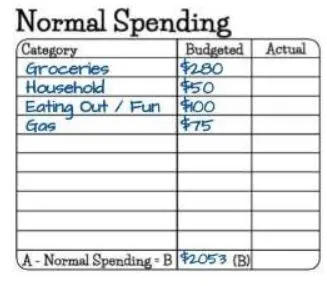

Here is below an image of how you could place a budget for a gamey spend category ( “ eat out / playfulness : $ 100 budget ” ) and start track your expense to make indisputable you do n’t go over budget .

For us , we even break up our food budget into weekly growth ( Week 1 , Week 2 , Week 3 , and Week 4 ) . That way , we bang that if we overspend in a calendar week , we have to slow up down the undermentioned calendar week to pay back what we overspent ) . pose a weekly budget target for eating out ( for instance , $ 40 per workweek ) , so that you bang you need to start eat in more regularly when you overspend .

Maybe you have another category that you consistently overspend ( like buying unexampled clothes , guilty again ! ) . you’re able to start by setting yourself a monthly goal to stay below $ 80 . Having a monthly number in mind can aid you keep your expenses in chip .

Money budgeting tip #3: Identify your triggers

If you ’re anything like me , then there are certain shoes ( coughing coughTarget ) that you ca n’t go into without picking up some thing that were n’t on your listing . This is especially unavoidable if I have had a hard workweek or need a pick - me - up . They do n’t call it retail therapy for nothing , right ? When you’re able to name your gun trigger , you’re able to budget for them accordingly .

If you know that you care to buy new lotions when you go to Target , correct by $ 20 in your budget to spend when you go to Target . If you know that when you have a harsh day at work , you like to nibble up a chocolate crescent roll at the local coffee shop , set apart $ 10 in your budget .

Money budgeting tip #4: Take advantage of any incentives for paying in larger increments.

When you do n’t clear a stack of money , it ’s harder to take vantage of the discounts offered with pre - payment choice . But that ’s why it is even more authoritative that you plan for it . you may often save as much as $ 100 , $ 200 or even $ 300 by pre - ante up instead of paying every month .

For example , our policy gives us a considerable discount rate for pay our premiums doubly a twelvemonth as opposed to monthly . By doing this we lay aside around $ 300 per year , so it ’s incredibly of import to us to take advantage of that welfare .

Look at your bills and see if there are mode to reduce your bills ’ overall cost by pay large increment . For example , add together an extra $ 25 per month to your reflex monthly withdrawals ( see budgeting tip # 1 ) for the purpose of paying your policy bills double a yr as counterbalance to monthly . It has a threefold welfare , as it also puts the money saved in your savings account to bolster your emergency fund .

Money budgeting tip #5: Give yourself grace

When we were first starting to budget , we fell frantically in love with Dave Ramsey ’s rule . We set about to implement them into our living as much as possible . However , we learned that often times , Dave encourages make sacrifices to make your budget oeuvre . These sacrifice mean not eating out , not make engagement nights , or scrub a costly membership .

We found that when we eliminated all of those things that bring us pleasure , our quality of life run down too . We could no longer go out to dejeuner with our friend on the weekend because it was n’t in the budget . We were n’t guide intentional time together because our date nights had to happen at house . What we have it off now is that many of these categories need to be reviewed but not necessarily eliminated . alternatively of take by dine out budget , just adjust it so that you could go out to eat twice a month instead of six prison term per calendar month .

If you enjoy fancy date nights out , plan to have one engagement night every other calendar month ( or else of multiple time per month ) . When you make these adjustments , you do n’t have to give your joy in the physical process .

Money Budgeting tip #6: Compare your budget

Compare your budget with the budget of other people with a standardised living situation and income . This will plausibly help you name area where you overspend . you could view Christine ’s frugal budgets here onhow to live on $ 2,500 per monthorhow to dwell on $ 1,500 per month .

You might also get some inspiration from Elly and Jessica ’s account , who work on Elly ’s personal budgetto save an additional $ 5,000 per year(Household income of $ 60,000 for two hoi polloi ) . you could also view all ourBudgetingresources .

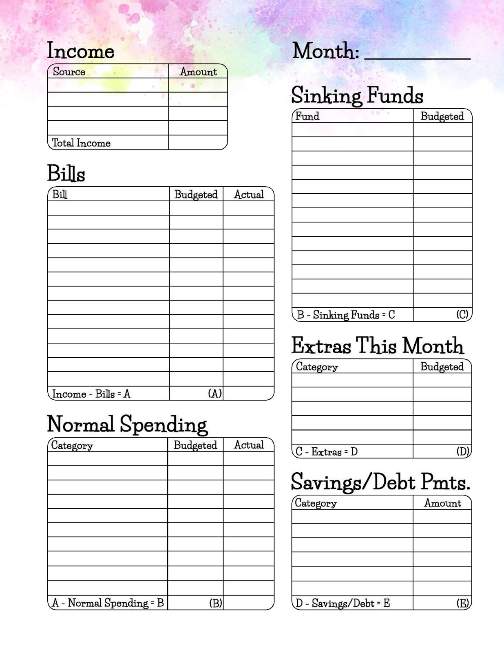

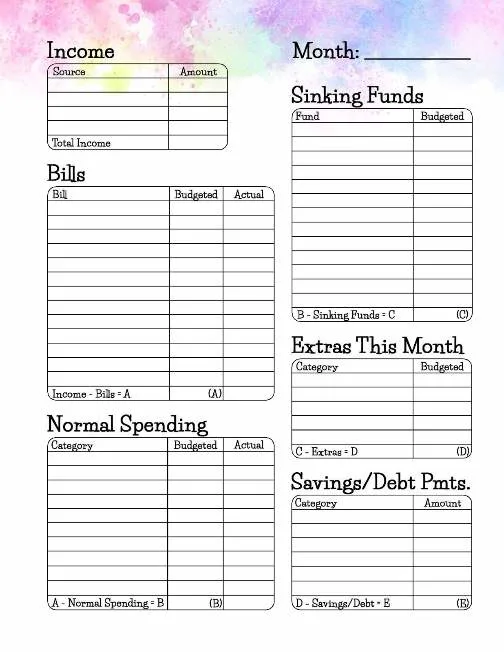

Downloadthis personal budget template to create YOUR first budget

![]()

![]()