This post may contain affiliate link . See revelation in the sidebar .

Back in 2010 , I was a poor student with virtually no saving . All my deliverance had been chop-chop swallow up by tuiton defrayal and I started going into debt .

When I started earning a full - time pay ( which was barely over $ 30,000 ) I began saving around $ 100 a calendar month . Over the years , I see aboutpersonal budgetingand funding and set up a strategy that pay off . I have been able-bodied to roll up $ 90,000 in savings , even though I started with a $ 30,000 salary . I still wish that I come out save earlier and if I had , I would have saved even more money .

I ’m sharing my money save tips here so you do n’t make the same mistake I did by waiting for so long ! Here are the 5 critical things to know with budgeting & investing :

1.A written budget. Because no one accidentally wins.

I taught myself how to make our own budget DIY , understand our expenses and hold open more money . With my first budget , I understood why I was capable to save small money . I fundamentally lived paycheck to paycheck and did not have a upstanding money save strategy . The first thing that I did was spell down my own budget to understand how I could economize more money .

Budgeting motivated me to save more money because i could see on the dot how much was going in-&-out . short the frequent restaurant take - outs and shopping shopping center purchases did n’t look as effective . I was able-bodied to carry through more , and devote off my debt a circumstances faster . This entail I no longer had to make interest payment and I could save that money for a downpayment on a condo ( no more rent ! ) and save enough money to be a good lifespan .

Read our simple tips tocreate your personal budget .

2.Automatic contributions to your savings account.

Budgeting helped me make unnecessary more money . But what did I do with the supernumerary money ? I set up robotlike transfers from my checking to my saving account . You do n’t have to earn a long ton of money to jump this ! When I begin , I only transferred $ 100 a calendar month .

Once I studied my budget and made some changes ( e.g. , reduced eating house and shopping disbursement , canceled unnecessary membership , switched insurance providers and reduced phone bill ) , I was able to save $ 500 a calendar month and begin commit this money to my savings account .

If you ’re like me , it ’s easy to let transferring money slip your mind . I urge redact it on autopilot that way you never have to think about it again . This way forces me to save first , and adapt my disbursement to make it work .

3.Investing in the stock market is easy

According to this article fromInvestopedia , the S&P 500 US stock market indicator has delivered an average reappearance of10 % annuallysince its inception . It ’s a great style to arise your savings and it ’s comfortable to get started .

I used to intend saving and investment were only for the copious . Sure , I ’d save money , but I was earn nothing in my deliverance account ( hello barely more than 0 % pursuit ) . If I was feel really lucky and adventurous then I ’d empower in a curt - term standard candle and make a few Pearl Sydenstricker Buck however , none of these scheme was go to get me rich or even close to financially inviolable .

As it turns out , investing is n’t just for rich people – I can do it too , I just wish I start earlier .

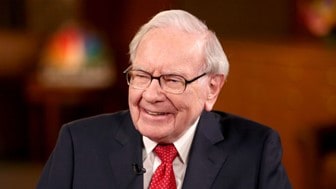

I set up up a Vanguard Account Online . When I say that it ’s easy to fix up a Vanguard explanation online , I ’m not hyperbolise . You choose the type of account statement ( I picked an individual taxable account ) , and then you provide your personal information . Next , you link your external bank explanation – the one you would use to fund your Vanguard account . Then you transfer your money and you are ready to invest ! I change a few hundred clam and bingo – it was that easy!I followedWarren Buffet ’s advice for personal investorsand for me , it worked out quite well : Warren Buffett thinks simple & popularindex fundsare the best manner for everyday investors to grow their money . Buffett is considered one of the most successful investors in the word and you ca n’t really go untimely by take after his advice .

study more details on investing in the blood line grocery by reading this chronicle on The ( mostly ) wide-eyed life story : how I saved over $ 90,000 .

4.Have a written plan to get rid of debt.

Did you know that the average pursuit rate that you get charged on your debt is 14.58 % for credit cards ( generator : WalletHub ) , 4.7 % to 6.2 % for educatee loan ( Source : Credible.com ) and 5.3 % for automobile loans ( source : ValuePenguin ) ? That ’s money you are handing out to the credit companies and that you should focus on paying down . When you create your first budget check that you plan for pay down your debt . Easier said than done !

See our clause : When to make unnecessary and when to pay off debt .

That ’s my list of the top hint that all adult female should experience about personal finance . have me know what you think by stake a commentary !

Are you quick to proactively manage your funds ? Our page onPersonal Budgetsis a respectable place to start . you’re able to readtips to budget your moneyand take in several household budget example to help oneself you get set out .