This military post may curb affiliate links . See disclosure in the sidebar .

Our completely insufferable goal is starting to face possible !

We set up a finish to devote off all of our debt by the end of this yr : $ 15,732 , which include our car and the new roof we had to put on our planetary house .

Based on our incomes and what I knew we could throw at the debt , it literally was not possible that we could reach this finish . I knew that .

BUT . You never know what a yr will work and I had hopes that by setting a cockeyed goal we would know what to do with every extra dollar we could add up up with . Well , I ’m feeling so motivated because it ’s start out to look like we might be able to make this happen !

you may scan the very start of our debt innocent journeying here .

The Progress

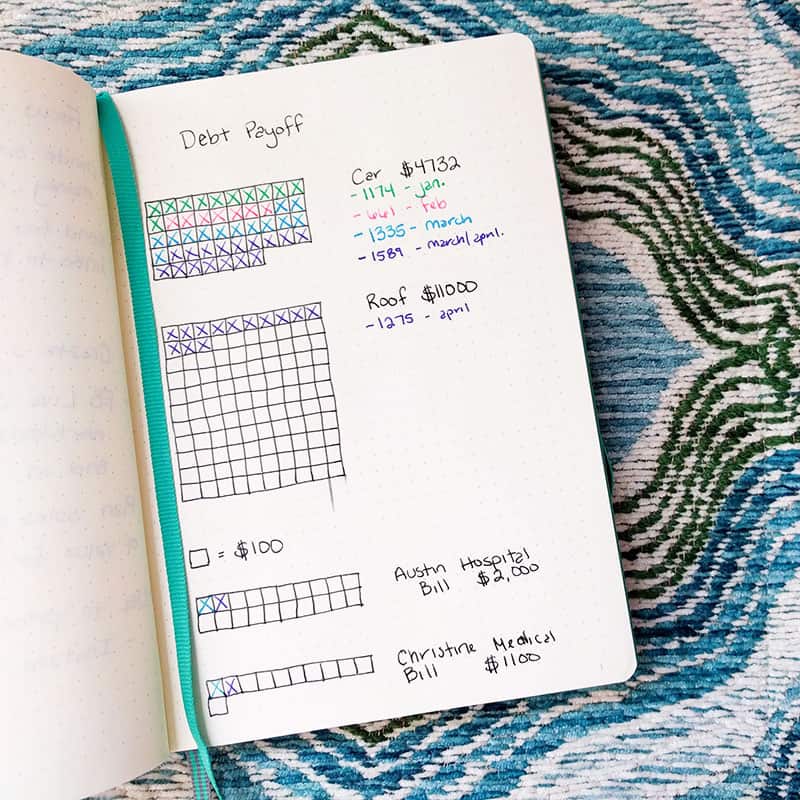

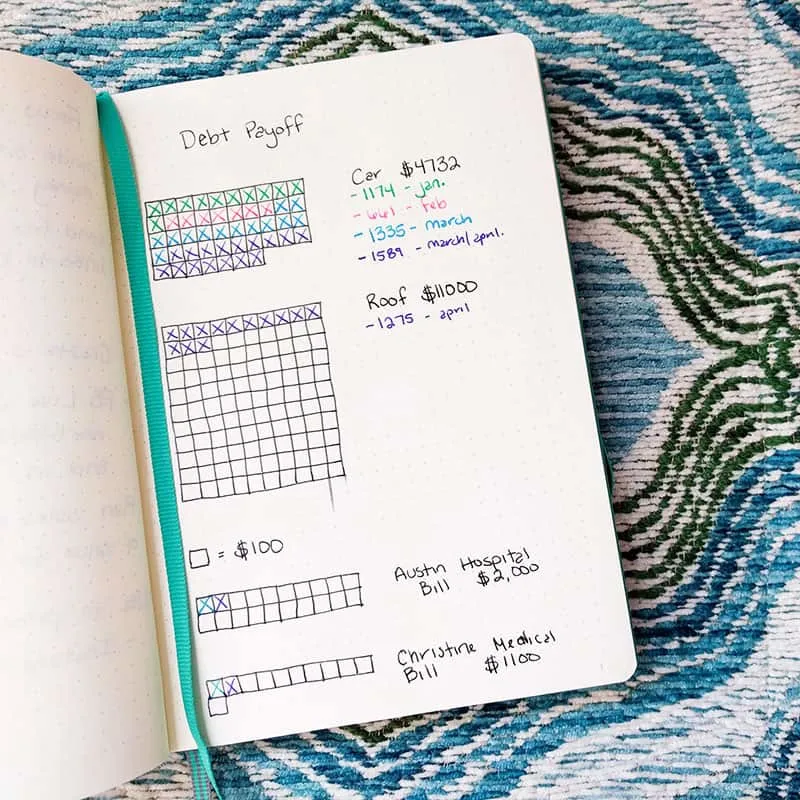

2018 Starting Total: $15,732

elevator car : $ 4732

Roof : $ 11,000

One of the problems we screw would pop up eventually was some aesculapian bills we were expect on . Unfortunately , we owe around $ 3,000 in medical banknote that are now sum to our situation . Womp - womp . We knew it was coming , but it ’s still a big fat bummer . Since the infirmary does n’t charge interest and set aside payment plans , we are paying about $ 200 per calendar month on these .

Medical Bills : $ 3,000

Current Total Debt: $12,325

Here ’s what my smoke diary looks like now :

That current amount would look a lot more telling if we had n’t had to add an supererogatory $ 3,000 , hahaha ! We ’ve made awesome progress though .

We ’ll have to pay an average of $ 1,370 on debt every month for the rest of the yr to make our finish , which seems utterly insane . We literally used tolive on less than $ 1500 per calendar month . We ’re doing our best though and have made better progress already than I had expected .

How We’ve Paid Off So Much So Quickly

frankly , I am still in a bit of jar when I look at our onward motion . I utterly realize that paying more than $ 1,000 on debt in a calendar month is a unbalanced amount of money .

I clearly call up months when I budgeted every dollar we had and was thrilled when I had $ 20 go out over at the final stage of the calendar month to add to our savings . So how have we been able to put so much money on our debt ?

Blogging

I ’ve been blogging for over two years and havejust this yearstarting earning more than what I used to make at my full time job . It has been year of heavy work and consistent effort and it ’s amazing to see it finally make up off . I palpate like I am contributing in a bigger agency to our finance which is exciting .

Since my income can waver hugely , we do n’t count on it at all for our regular monthly budget . This means that we can use whatever I make ( after taxation and expenses ) to pay off debt .

Blogging is not a quick way to make money , but I love what I do ! If you have an interestingness in blogging , you should perfectly give it a try .

you’re able to get started blogging withBig Scoots(the hosting company I apply and enjoy ) for as little as $ 3.55 per calendar month for shared hosting . Be certain to read about thethings I wish I would have knownwhen I started blogging andtheonlythree blogging coursesI would take if I could start out over .

How cunning is this film that face like Mozzie is blogging ? He was just sitting on my lap making it impossible to get anything done 🙂

The Magic of the 3-Paycheck-Month

Austin gets pay up bismuth - weekly , which means that there are two month each year where he gets three paychecks alternatively of two . March was one of those month .

I plan our budget around two payroll check , so the third is fundamentally unplanned money when it happen ! We used most of his third paycheck to devote off debt .

Ways We’re Saving Money

You Might Like These position Too :

How to Have Fun While You ’re pay Off Debt

When to Save and When to Pay Off Debt

How to Live on $ 2500 Per calendar month : Our Actual Budget

55 Budget Categories You Do n’t require to Forget