This Emily Post may hold affiliate connection . See disclosure in the sidebar .

create your first budget can be overwhelming ! It ’s ruffianly to know how much you should be drop or where to even initiate .

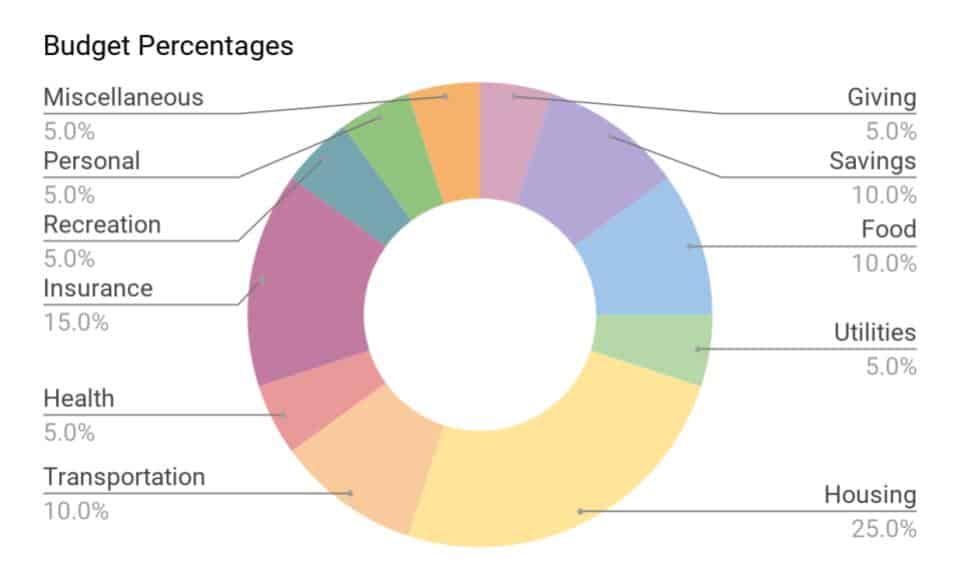

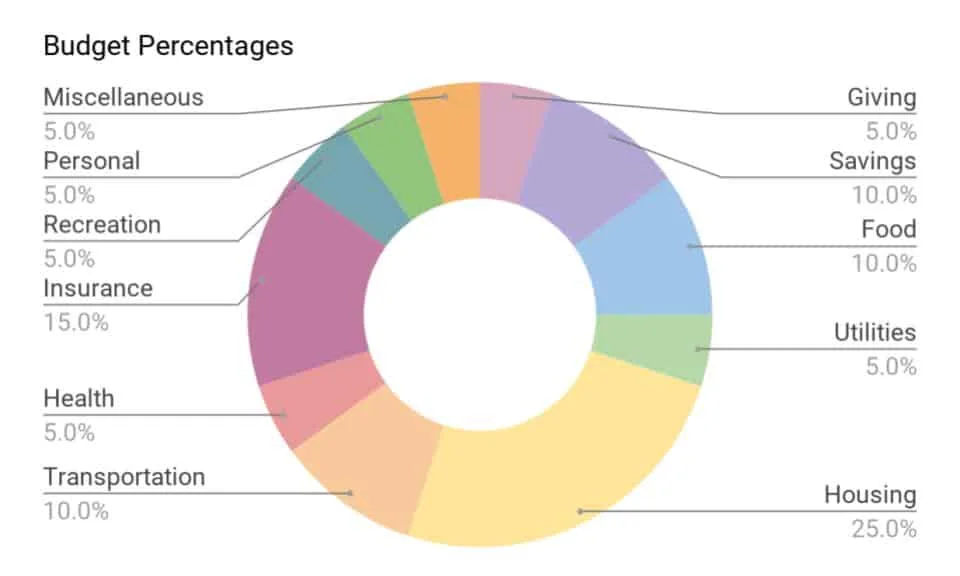

Today , I want to give you a starting budget . I did some research on the commend percentages that each category of your outlay should take up from your income . We ’ll break down what that look like based on a few different income levels .

But here ’s the number one matter to retrieve : This is just a scratch .

Your housing costs may be high because of where you live . Maybe you spend more on aesculapian bills but scarcely ever purchase raw clothes , so your health spending is more but your personal disbursement is less . No trouble !

This is just a derail off point and then you’re able to correct the numbers pool in a way the works for you .

Personally , I like to have a starting point like this so that I can make changes based on my situation . I just need somewhere to set out !

Sidenote : Want to improve your financial berth ? One of the very good things you’re able to do is track your outgo ! you’re able to download and print my free spending tracker printable and take action today !

[ convertkit form=980628 ]

The Percentages

Here are the pct we ’ll be using to get our numbers , plus a brief explanation of what that category encompasses .

You ’ll notice that if you were to apply the high range of each category , you ’d finish up with well over 100 % , which of course does n’t function . This is where you ’ll have to balance things out based on your needs .

You might be on the low ending for shipping costs , but on the high end for trapping . You get the approximation , ripe ?

evidently this is a pretty dim-witted budget breakdown . I personally like to have more detailed family . For example , I sort our food market spending from our deplete out money in our budget . So your categories may look altogether dissimilar , but they in all probability all descend under the umbrella of one of these large categories .

NOTE : For all of these budget starters , the monthly income is establish off ofwhat you take home after taxes but before anything else is lease out(like retirement or health insurance ) .

$2000 Per Month

$3000 Per Month

$4000 Per Month

$5000 Per Month

If you ’re working on your budget , I go for it helps to see these breakdowns . From here , you’re able to adjust how much you apportion to each family based on your alone spot .

The most important affair is plainly to inhabit below your agency — expend less than you make , otherwise you ’re going deep into debt each calendar month which is obviously no good .