envisage that you and your spouse have a babe on the way of life . You were n’t planning to start a family quite this before long and your family reverberate that . The two sleeping room one bath bungalow seemed like a perfect starter home for two people , but now it feels too small to let in a third . You love this house , so you desire to make it make . The lot ’s bragging enough to add on an redundant room - the nursery . you’re able to just knock out the back bedroom paries and go from there . Or , maybe you could elaborate the kitchen while you ’re at it , tack on a one-half tub and the nursery . That would be slap-up . But where will you get the money to pay for therenovation ?

In this clause we ’ll look at what it mean to take up against theequityof your home , what the various types of home plate fairness loans are , and when it may be the right time to get one .

In the next section we will take a spirit at some of the BASIC .

Home Equity Borrowing Basics

There are a few different type of loans that allow you to use equity in your theatre as collateral . One type , the more traditional of the two , is known as a home equity loan orsecond mortgage . When you take out a second mortgage on your place , you are borrowing one clod sum of money from the bank . You will be required to pay back the loan over a fixed geological period of clock time at a designated sake rate . For a project like a remodel or overhaul , where you ’ve get an estimation from the contractor and you know what you need , a second mortgage is a good idea .

Now that you understand the rudiments , let ’s take a close look at equity .

About Equity

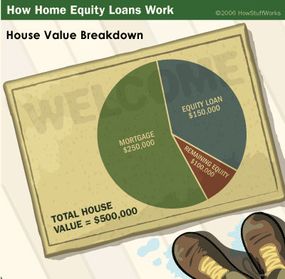

As we mentioned earlier , borrowers have several options when it fare to borrowing against the equity of their abode – a rest home equity loan ( also commonly called a secondmortgage ) , a home fairness credit line ( also called a HELOC ) and a rearward mortgage . A household equity loan or 2nd mortgage is establish off ofequity , or the amount of time value you have in your menage . Because homes more often than not appreciate in value over time , fairness is calculated by taking the difference between the current Charles Frederick Worth of your home and how much you owe on your initial mortgage . Say you buy your sign for $ 350,000 and you have paid off $ 175,000 of a $ 300,000 mortgage . A recent appraisal puts your home ’s time value at $ 500,000 . You would figure your current fairness in your house like this :

$500,000 - $125,000 = $375,000

The $ 125,000 number is the amount of money yet to be give on your mortgage . And because your house has appreciated in economic value – moderately like a ancestry or a worthful antique – so has your equity in your home plate increased . In many case , you may be able-bodied to practice this investment toborrow againstyour fairness for get another loan . And just like with your first mortgage , your house serves as thecollateralthat guarantees your loan to thebank . If you ca n’t pay off your second mortgage , you may be forced to sell your family , or the bank might clutch it .

often , the length of a second mortgage is shorter than the first , though they can last anywhere from five to 30 years . Still , second mortgages are generally intended to be for smaller amounts than the first , for consolidate debts , financing an addition to a home or helping to make up for a kid ’s college tuition . But in some pillowcase , homeowners simply like to take advantage of a dear investiture by take up against the rising equity of their rest home and thereby gaining some financial flexibility .

Home Equity Loans and Reverse Mortgages

Ahome equity loanis most useful when you need a specific amount of money for a project or investment . As we ’ve make , a home equity loan involves borrowing against the equity in your household . The loanword comes in a fixed amount that is repayable over a primed period of time , which is why this eccentric of loanword is commonly touch on to as a 2d mortgage . The requital schedule is usually designed around equal payments that will eventually pay off the integral loan .

Like with other character of equity plan , the involvement on a home fairness loan may be tax deductible up to $ 100,000 .

As with a home fairness loanword , the borrower ’s home serves as the collateral in aHome Equity Credit Line ( HELOC ) . In a basic sense , a HELOC work like a kind of acknowledgment card . The lender examines various factors like the borrower ’s income , credit history , expenses and other debts and sets the credit limit at a percentage of the plate ’s equity .

There is a limit time frame applied to a HELOC , but it solve slenderly differently than with a home equity loanword . The first fourth dimension physique – say , five twelvemonth – is the menses during which the borrower can draw money using special checks , electronic transfers or even a special credit card . Different plans have different rules , but in some cases a lower limit amount has to be bow out each time . Like a credit card , the borrower has a limit on how much money is at his or her disposal . If the borrower reach the pre - established limit , he or she can not borrow any more money without paying off some of the great debt .

The second meter frame comes at the end of the adoption period . Some plans have an option for renew the quotation stemma while others require a repayment of the debt – unremarkably over another fixed prison term period . In other cases , the outstanding debt can be “ rolled ” into a traditional loanword at the end of the drawing period .

Because the terms of home equity credit line diverge , it ’s important to find one that fits your specific needs . When prefer one of these architectural plan , consider the annual per centum rate ( APR ) and other price of the plan . Like many other eccentric of loan , a home fairness architectural plan can come with many fee attached , though some lenders may parcel out with some , or even all , of the charges . In any case , these charge often admit an lotion fee , property appraisal , initial explosive charge such aspoints(which go against your mention demarcation line ) , attorney ’s fee , title search , mortgage preparation and filing fees , property and title insurance policy , taxes , rank or sustentation fees and even dealing fees when drawing on the line of credit rating .

The structure of the drawing and quittance stop should be consider cautiously . Is the refund menses too short ? Will you be able-bodied to make payments against the interest during your drawing period ? These are only some of the interrogative sentence to ask when considering a dwelling house fairness contrast of recognition . Also , if you are concerned that the power to draw on a line of acknowledgment almost at will offers too much flexibility or will entice you to spend to a fault , then this is probably not the character of loan for you . But if you call for money in instalment – perhaps for paying a contractor for more than one labor or paying tuition , a domicile fairness line of credit entry can be a very good pick .

Reverse Mortgages

A reverse mortgage can seem like a contradiction in terms in term . It ’s money that the bank pay you that you might not have to repay for the rest of your life . You do n’t even have to have an income to be eligible .

There are , of course , weather attached to a inverse mortgage . First , you have to be at least 62 class of age and survive in the dwelling applying for the rearward mortgage for at least 50 percent of the class . You also have to own your home . In some instance , if you have a relatively small amount persist on your abode mortgage , you could get a cash progression from the rearward mortgage to pay off the relaxation of the debt on your house .

But the idea of a loan that you never have to repay can be misleading . If you betray your reversal mortgaged home or permanently move out , you have to repay the loanword . If you do stay in the home and keep the reverse mortgage until you pass away , the mortgage is design to be bear off with the value of the home . But if your heritor wish to keep the house , they will have to devote off the loanword . Otherwise , it will likely become property of the lender , or if the home is worth more than the loanword balance , your heirs may sell the place , repay the loan and retain the departure .

Unlike a traditional or “ forward-moving ” mortgage , a reverse mortgage postulate rising debt and fall equity . Your debt increases as your equity lessen .

Among the dissimilar types of rearward mortgage , aHome Equity Conversion Mortgage ( HECM)is the only rearward mortgage that ’s federally insured . The HECM program confine loanword cost and recount the lender how much they can impart you . This mortgage can be cheaper than other reverse mortgages . unremarkably only reverse mortgage offered by state of matter and local political science are cheaper than an HECM , but those often must be used for a particular purpose and are mostly available to those in abject income brackets . If you ’re interested in how much you may receive through an HECM or a Home Keeper Mortgage from Fannie Mae , try thismortgage calculator .

Read the Fine Print

To protect consumer from inscribe into unjust loanword agreements , the United States Congress passed theConsumer Credit Protection Act , also acknowledge as the Truth in Lending Act , in 1968 . According to the act ’s provisions , a lender must divulge important term and toll of house equity plans , APR , payment terms , information about variable rates and any other mixed charges . The human activity also take into account three business twenty-four hours from the time an account is opened for the consumer to scratch the agreement . In case the borrower does decide to strike down the loan , he or she must inform the creditor in writing , and the creditor then has to cancel theirsecurity interestin the borrower ’s home and yield all software and loan fee .

The Consumer Credit Protection Act is specially significant when considering that some multitude seeking second mortgages may be in difficult , or even do-or-die , financial shape . Because of that , unscrupulous lenders may endeavor to take advantage and offer them terms which they can not afford or in secret change aspects of a loan agreement .

If the three - business day cancellation period egest and you decide that you have somehow been take advantage of , report your lender to theFederal Trade Commission . you may also get hold of consumer protection way , housing counselling way or your commonwealth bar tie-up for referral to a lawyer .

Differences and Similarities

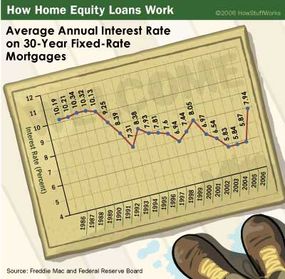

One advantage of a home fairness loanword is its fixed pursuit rate – you know how much you ’re go to be charged each calendar month . A menage fairness line of credit generally has a variable sake charge per unit based on a publicly useable index . While a variable interest rate means more uncertainness regarding how much you ’re choke to be give in interest , it also offers some flexibleness in that you ’ll usually have the option of paying interest only , or pay off interest and some of the principal .

The index that watch interest rates are the prime rate find in newspapers or the U.S. Treasury Bill ( “ T - Bill ” ) charge per unit . A variable interest group rate will alter as these interest rate switch , but a varying rate plan must also have a cap on how high the rate can go during the terminus of the programme . Some also have limits on how much the interest charge per unit can fall . These rates alter when theFedraises or lowers pursuit rates . Keep in nous that many lenders bring amarginto their sake rates , which is usually measured inpoints . For case , if the prize rate is 4.5 percent but your lender ’s charge per unit includes a one - point tolerance , then your interest pace will be 5.5 percent .

Some lenders permit you to commute from a variable pace to a fixate - charge per unit during a menage fairness plan , or to convert some or all of your debt to afixed - full term instalment program . Other lenders may not allow you to withdraw money when your pursuit rate reaches the pre - establish cap .

Repayment and Some Tips

The repayment process for a family equity loan or a home base equity line of credit is subject on the terms of the plan . Some fairness plans only require you to pay pursuit during the loanword , leaving the entire principal to be make up once the loan is due .

If your plan ’s requital schedule leaves a remaining balance at the destruction of the program , be fain to make aballoon requital . A balloon requital can be done with money on hired hand , by refinancing the loan or by taking out a loan from another lender . Not being able to pay up a balloon payment means that you could misplace your place .

Usually your payment choice are pliable , allow you to pay up more than the minimum payment . Because of this tractableness , many home equity borrower make regular payments to the principal sum to avoid being stuck with an outstanding balance when the loanword is due . If for some reason you decide to sell your home before the terminal of your programme , you will in all probability have to repay your fairness loan .

Advice for Equity Plans

Before you decide to get a home equity loanword or HELOC , ask yourself if you could give to take on more debt . Is your employment situation stable , and if so , will you be able to finally give back the loan ? If you ’re dealing with money trouble , speak with a credit guidance agency can be very helpful . If the problem is in pay your mortgage , you’re able to get a listing of approved housing counseling agencies from theDepartment of Housing and Urban Development . In ecumenical , it ’s ripe to get a home equity loan only when you have a specific usance in mind for it . While a home fairness transmission line of credit offers more flexibleness than a abode fairness loanword ( second mortgage ) , using it like just another reference card can get you in trouble down the road .

Once you ’ve decide you need a home fairness loan , it ’s important to tell on around . check that the lenders you speak to are reputable . Predatory lendersprey on the elderly , attempting to play tricks them into accepting unmanageable loans , or on citizenry with low income or credit problems . Ask friends and relative about the banks they have dish out with , and research the lender you ’re working with to make certain they ’re dealing in near faith .

With so many fee associated with a loanword and things like variable interest rate , it can be hard to define on the button what makes one loaner estimable than another . try on using thisworksheetfrom the FDIC for comparing dissimilar loanword go . It will give you some unspoiled interrogative sentence to expect and will allow you to keep the info about each lender direct .

Do n’t hesitate to talk terms with your prospective lenders . Think of it like shopping for a machine . Let them hump you ’re shopping around , and ask them to glower the various rates , fee and points . Make them beat the term of another lender .

Once you choose a lender , get a “ beneficial faith estimation ” of all charges . By law , the loaner must send you an estimation within three days of your diligence . canvass the forms you receive , and most of all , ask questions ! One or two weeks before close , expect the lender if the terms have switch from what was in the good faith estimation .

If you bonk someone with loan experience , such as an accountant or tax attorney , ask them to bet over the estimate , loanword paper and declaration . Again , verify to ask any interrogation you may have . Do n’t be rush into signing a contract bridge if you ’re unsure of something or if some language in the correspondence is ill-defined . Do n’t contract forms that have blank fields . If your loaner tell you they are imagine to be vacuous , get a line through the field and initial it .

Most of all , do n’t get a loan for more money than you need or for terms you ca n’t give . Even if the loaner promise you that the full term are favorable , taking on ahigh loan - to - value ratiocan make repaying the loanword difficult and adventure your home ownership . The loan - to - value proportion is the proportion of what you owe on your house to its overall value . Generally , lenders attempt to keep your loanword - to - note value ratio below 80 percent . For example , if you owe $ 250,000 on a $ 500,000 house , you already have a loan - to - value proportion of 0.50 or 50 percent . For a second mortgage , a loaner likely wo n’t offer you more than $ 150,000 , which would put you at $ 400,000 in full loan – or a loanword - to - economic value ratio of 80 percent ( $ 400,000 divided by $ 500,000 ) .

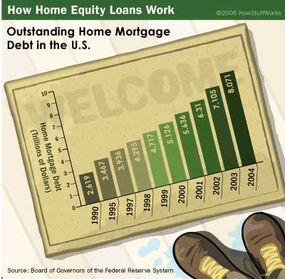

It’s important to avoid getting tied up with too much mortgage debt.

Try to have a loan-to-value ratio under 80 percent.

Some lenders will go over 80 percent or even offer you a loan for more than your household is worth . try out to avoid those loanword as they will likely transmit high stake charge per unit , require mortgage insurance and be more unmanageable to pay off if you ’re forced to sell your home .

For more information about home fairness loans and related to issue , watch out the links on the following Thomas Nelson Page .

Home Equity Loans FAQ

Lots More Information

Related HowStuffWorks Articles

More Great Links

Sources