This post may contain affiliate inter-group communication . See disclosure in the sidebar .

I used to think saving and investing were only for the deep . Sure , I ’d make unnecessary money , but in my savings account ( hello barely more than 0 % interest ) and if I was feeling really lucky , I ’d invest in a short - condition CD and make a few bucks . Nothing that was going to get me rich or even confining to financially secure .

I assumed , this was it – this was how was supposed to save money . I did n’t have a spate of money . sure as shooting , I made a decent income and did n’t know paycheck - to - payroll check , but I did n’t have Warren Buffet type money either so investment were off the tabular array .

As it turns out , they were n’t , and I kind of wish I started earlier . Nonetheless , I was able to save $ 90,000 and today I realize $ 300 a calendar month in passive income because of my habits . I ’m sharing them here so you do n’t make the same mistake I did and waitress so long . Start saving money today , whether you have $ 100 or $ 10,000 – there are investments for everyone .

The good news is that it ’s easy to get start up even with $ 100 .

How I saved $90,000

When I say that it ’s easy to set up a Vanguard account online , I ’m not exaggerating . You take the case of bill ( I chose an item-by-item taxable account ) , and then provide your personal information .

I provided my name , Social Security figure , nascence date , computer address , and employer name . Vanguard does n’t share or sell my information so I finger comfortable providing this data .

Next , I linked my outside depository financial institution chronicle – the one I would practice to fund my Vanguard story and I transpose a few hundred dollar bill . I was ready to invest – it was pretty well-to-do .

One of the primary ground I chose Vanguard to carry through money was the commission - gratis trades . All exchange traded fund have no charge costs , which means more money in my pocket .

I started by transferring $ 100 a calendar month , but once I give-up the ghost over my budget and made some change ( cut the cord , cancel unnecessary membership , and switched indemnity providers ) , I was able to save $ 500 a calendar month .

I set up robotlike transfer . I extremely recommend this . If you ’re like me , it ’s wanton to let channelize and salve money mistake your mind . Before you have intercourse it , a few months clear and you did n’t save anything . I put it on autopilot and never had to think about it again .

I know , this part is shuddery , but I did my research . I followedWarren Buffet ’s advice for personal investorsand for me , it worked out quite well : Warren Buffett thinksindex fundsare the practiced way for everyday investors to mature their money . Buffett is considered one of the most successful investors in the word and you ca n’t really go wrong by following his advice .

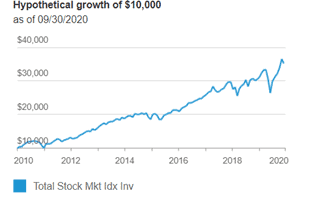

Anindex fundis an investment that tracks a marketindex , like the DOW Jones or the Nasdaq . Vanguard even has an selection to invest in the integral U.S. stock food market . It ’s called “ Vanguard Total Stock Market Index Fund ” . Other breed factor also have full stock market funds , include Fidelity with their “ Fidelity Total market index fund ” .

So how well does an “index fund” perform?

I kept most of my investments in this Total Stock Market Fund . you’re able to see the graphical record below that render it performed really well since 2010 . A $ 10,000 investment in 2010 would have “ hypothetically ” grown to over $ 35,000 in 2020 . Not unfit .

I did this for 10 class and voila – I had $ 90,000 in my Vanguard account in what felt like the nictitation of an centre and all because I automatically transferred $ 500 a month to my Vanguard account .

- Disclaimer – These result may not be suggestive of what you accomplish , specially if you ’re starting now in the tumultuous economy . The Dow Jones getting even in the past 10 years has been good , but there ’s no guarantee it will continue moving forward .

How I generated $300 per month in passive income

Here ’s the fun part . Now I had this $ 90,000 , which is with child , but I ca n’t retire on it – I need A LOT more to retire , but it was a slap-up start .

But I wanted my money to work for me . In other word , I want peaceful income . Monthly income to be exact . Because I ’m still not a stock expert , I stick mostly with Vanguard funds , after all , they have n’t disappointed me yet .

Here ’s the divergence . I focus on dividend funds rather of forefinger pecuniary resource . This is where the passive income get-go . Dividend fund devote me dividend ( part of the party ’s profit ) either monthly or quarterly , it depend on the stock .

I purchase several funds on Vanguard , including VHYAX , VYM , and SPYD ( this one has a higher yield ) . These investments keep me in the stock market but pay me every month or every after part .

On average , I earn $ 300 a month in dividends , which means more buying tycoon in the market . I still lend my normal $ 500 a calendar month , but if I can bump it up to $ 800 , imagine where I ’ll be in 10 more years .

Will this mold for you ? It depends on your dedication , danger permissiveness , and the power to transplant funds on a regular basis . Remember , you may or may not have the same results as me – the grocery store is unpredictable .

you’re able to also get wind how to create a budget to manage your money and increase your savings to be able to invest more in the stock market .

Some of you may be concerned about losing money in the stock market , and that ’s a very valid concern . The grocery store can be up or down in any given year . If you want to reduce your risk of exposure because you do n’t like losing money in any give way class , or because you call up you will need the money in a few class ( for instance for a down payment on a house ) , you may want to follow a more conservative approach . For illustration , you could enthrone 70 % in a total store market fund , and 30 % in a John Cash reserve fund like “ Vanguard Cash Reserves Federal Money Market Fund(VMMXX ) ” . This will protect your investing in case of a downturn .

No matter what , though , consistence always wins , even if your history sees major ups and down ( thanks to the pandemic and election ) , if you stick it out , you should see progress that mimics or come close to mine .