This Emily Price Post may bear affiliate links . See disclosure in the sidebar .

Last year we did what we thought was the impossible : We paid off just under $ 19,000 of debt in 10 month to become debt destitute except for our sign of the zodiac !

I am still astounded at how we managed to pull this off and how it has positively sham our lives ever since — we ’re currently saving up to move across the country which has been our dream for years and would not have been possible with so much debt .

I wrote a few web log station about our journey to becoming debt free as it was fall out , and I wanted to put them all together for you so that you could learn from our whole experience in one place . So here it is !

Since this is a passing long berth ( essentially 4 posts in one ) I made a little table of contents that you’re able to employ to skip to unlike sections :

The Beginning : The Debt , the Plan , & the ProblemsUpdate # 1 + How We ’re cause Such libertine ProgressUpdate # 2 + Ways to Increase Your IncomeFinal Update : Our Best Debt Payoff Tips

How to Become Debt Free: Our Full Journey

Favorite Resources:

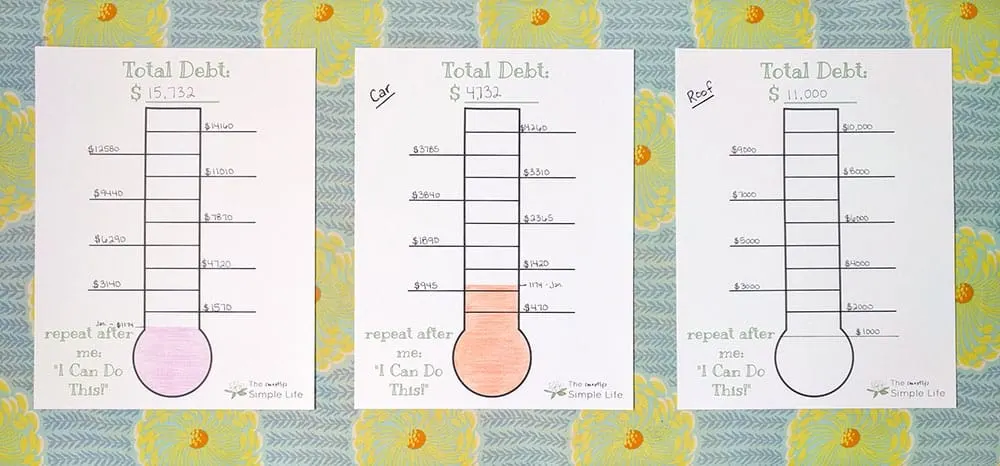

Debt Payoff Thermometer Printables

Being able to see our progress was tremendously motivating ! you’re able to get my debt payoff thermometer printables for loose and take off tracking your journeying !

[ convertkit form=834534 ]

Total Money Makeover

We do n’t follow every single affair Dave Ramsey recommends , but you ca n’t blab out about debt reward without mentioning him , right?Total Money Makeoveris really skilful . It put out a bare plan and is exalt . If you want to become debt free , interpret it !

The iSaveMoney App

I used this app to track our spending throughout most of our journeying . Staying on budget each month was key to having money leftover to pay off more debt . you could look this app up in the app store on your phone to try it out .

The Beginning: The Debt, the Plan, & the Problems (January)

Our massive fiscal goal for the year is to become debt - free ( again ) . We ’ve been debt - complimentary in the past times and unfortunately we had to take on some debt over the past twelvemonth or so . I ’m very quick to put down it so that we can have our full income back !

Here ’s the thing : This is an impossible finish . As our incomes currently fend , it does n’t await like there ’s any way we can make this happen . But that ’s not stopping us !

Between a potential revenue enhancement issue , side jobs , and income fluctuations ( blogging is like a roller coaster y’ all ) , we just might make more money than we presently expect .

Plus , and this is important , I know that in this circumstancewe’ll get far by aim big than we would if we arrange an easy to accomplish goal .

I design on posting updates every few months on how we ’re doing with ‘ mission impossible ’ .

The Debt:

Car: $4732.00

Last winter , our previous car was becoming more expensive to repair than it was worth . We traded it in and baffle a new - to - us little car and took out a loan of a little over $ 8,000 . This was a major bummer since we were completely debt - free before this . We ’ve been confound extra money at this loanword over the retiring year and have made some decent advancement .

Roof: $11,000

We bought a sign in 2017 that look like it might need a ceiling in the next few years . unluckily , we were n’t able to have the roof amply inspected before we shut down because of coke on it . ( Note to ego , never buy a house in the wintertime . ) It turned out that the cap was actively leak out into a bedchamber every sentence it rain . We tried patching things , but by downfall it was clear that we necessitate to just replace the whole thing before another winter . My parents were so kind to lend us the money to make it happen and I ’d very - much like to compensate them back ASAP .

Grand Total: $15,732

Ok , type that was the first metre I ’ve actually totaled it all up . I may have had a mini mettle attack … Moving on …

The Plan

We ’re plan on focus all extra money on the railcar loanword first to get that out of the style . That will free up some extra income since we wo n’t have a car defrayment to concern about ( ca n’t hold back ! ) .

Then we ’ll get down plugging away at the ceiling loan . $ 11,000 is the largest loan we ’ve ever had other than a mortgage , so it ’s looking a short intimidating to me right now .

Dave Ramsey calls this method snowballing . You put all redundant money toward your smallest loan until it ’s go . Then you take all of the money you were using against the smallest loan and put it all towards the next smallest loanword . As you go , your snowball of requital get under one’s skin bigger . I commend his book , The Total Money Makeoverif you need more info or stirring about pay off off debt .

The Problems

I notice that I ’m more successful at accomplishing a finish when Ianticipate problemsand decide how I will handle them before they come up . I extremely recommend thinking about what problems you might receive while you ’re working toward a destination and adjudicate ahead of time what you will do if one come up .

Here ’s where I foresee issues :

Progress

I had a expectant month in December for my blog ! Plus , I got pay betimes for my ads , which was super nice . I ’m make water an special crowing car payment for January — Our veritable payment + $ 1,000 ( ! ! ! ) .

2018 Starting Total: $15,732.00

January Total: $14,558.00

Update #1 + How We’re Making Such Fast Progress (April)

Our whole unacceptable goal is starting to look potential !

We set a goal to pay off all of our debt by the end of this class : $ 15,732 , which includes our car and the new roof we had to put on our house .

Based on our incomes and what I know we could throw at the debt , it literally was not potential that we could touch this goal . I knew that .

BUT . You never live what a class will bring and I had hopes that by arrange a ridiculous goal we would have it away what to do with every extra dollar we could total up with . Well , I ’m feeling so motivated because it ’s get going to look like we might be capable to make this happen !

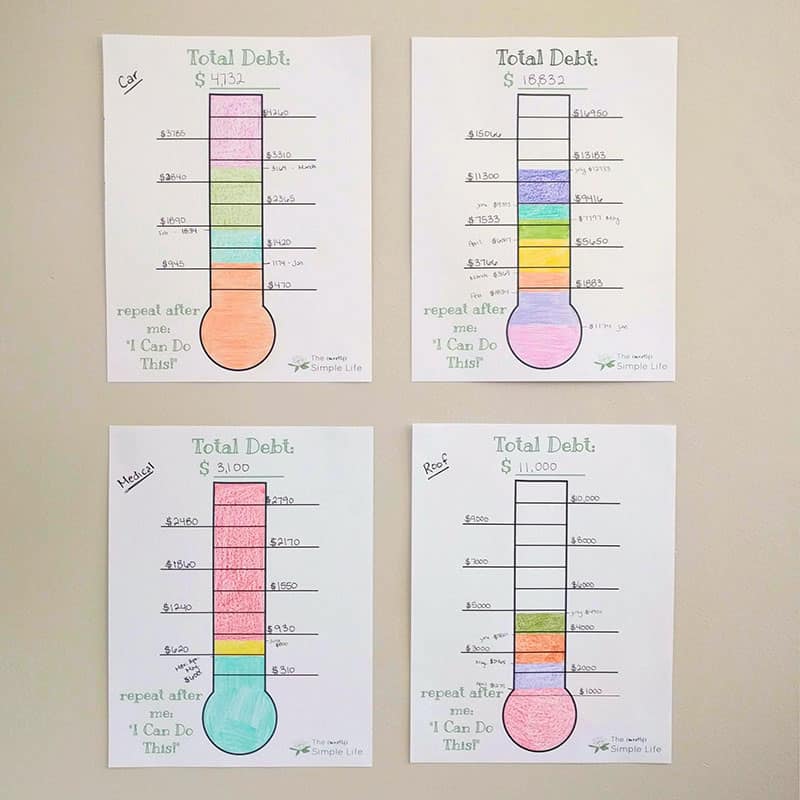

The Progress

2018 Starting Total: $15,732

elevator car : $ 4732

One of the trouble we know would pop up finally was some medical account we were expect on . alas , we owe around $ 3,000 in medical bills that are now added to our berth . Womp - womp . We knew it was coming , but it ’s still a big fat bummer . Since the infirmary does n’t load interest and allows defrayal plans , we are pay about $ 200 per month on these .

Medical Bills : $ 3,000

Current Total Debt: $12,325

That current total would look a portion more telling if we had n’t had to add an extra $ 3,000 , hahaha ! We ’ve made awesome advancement though .

We ’ll have to make up an average of $ 1,370 on debt every month for the rest of the year to make our goal , which seems utterly insane . We literally used tolive on less than $ 1500 per month . We ’re doing our in effect though and have made better progress already than I had expect .

How We’ve Paid Off So Much So Quickly

aboveboard , I am still in a chip of shock when I count at our progress . I absolutely realise that paying more than $ 1,000 on debt in a month is a crazy amount of money .

I distinctly recollect months when I budgeted every one dollar bill we had and was beatify when I had $ 20 left over at the end of the month to add to our economy . So how have we been able to put so much money on our debt ?

1. Blogging

I ’ve been blogging for over two year and havejust this yearstarting clear more than what I used to make at my full metre job . It has been years of hard work and consistent effort and it ’s amazing to see it lastly pay off . I feel like I am kick in in a larger manner to our finances which is exciting .

Since my income can vacillate tremendously , we do n’t number on itat allfor our regular monthly budget . This means that we can utilize whatever I make ( after taxes and expense ) to pay off debt .

Blogging is not a quick way to make money , but I have sex what I do ! If you have an interest in blogging , you should utterly give it a try .

you could get started blogging withBig Scoots(the host company I apply and jazz ) for as little as $ 3.55 per month for shared hosting . Be indisputable to learn about thethings I like I would have knownwhen I started blogging andtheonlythree blogging coursesI would take if I could start over .

2. The Magic of the 3-Paycheck-Month

Austin gets pay bi - weekly , which means that there are two month each year where he gets three paychecks or else of two . March was one of those months .

I plan our budget around two payroll check , so the third is essentially unplanned money when it take place ! We used most of his third paycheck to pay off debt .

Update #2 + Ways to Increase Your Income (July)

Y’all . Big things have happen in our debt complimentary journeying !

We started working toward this goal in January . Back then , it was literally an impossible goal . The numbers did not add up in any way , shape , or form . With a promotion for Austin and my blogging income much higher than expected , the impossible started to look possible a few months ago .

Here we are , a little over halfway through the year , and I ’m not - so - secretly thinking we might be debt free around October !

The grown reason we might be capable to pull this off : Increasing our income!As someone who has always focused far more on save than on earning , I have to tell you , the ‘ earning more ’ brainpower has been an eye untier for me !

I ’ll explicate HOW we ’ve increased our income and give a clump of ideas for how you could too .

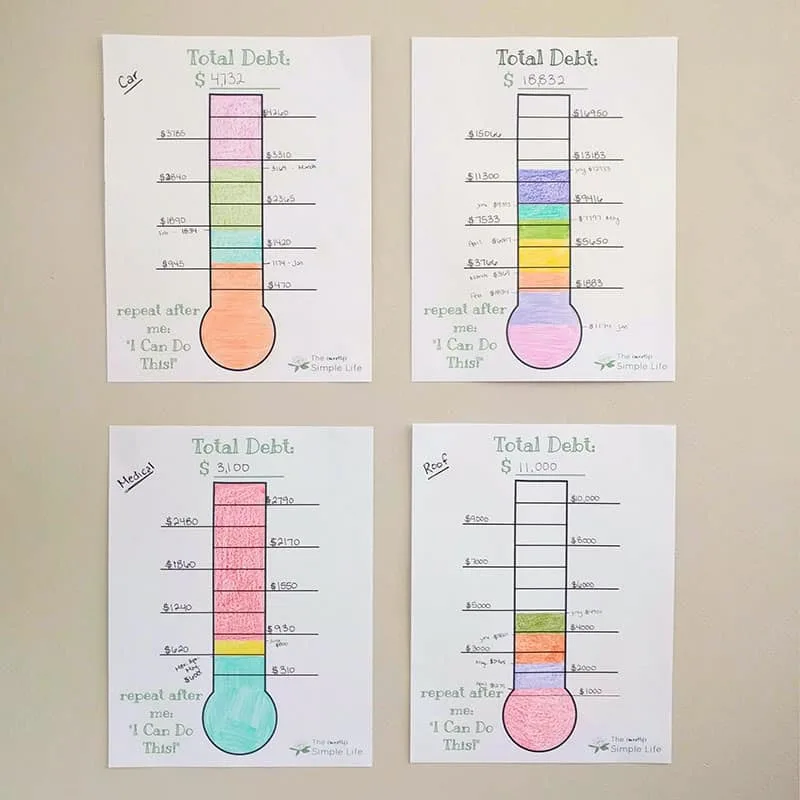

Total Debt: $18,832

Medical Bills : $ 3,100

Current Total Debt: $6,099

We ’ve made HUGE advance in May , June , and July !

Instead of keep to make payments on the aesculapian bills , we decided to rap those out whole . We do n’t have any interest on the aesculapian bills or the cap , so it did n’t inevitably matter either way of life , but I ’m glad to have them done for ! All additional money now goes towards the roof debt .

Our debt return thermometer are take care fabulous !

Finding Ways to Increase Your Income

You might have noticed that we made debt payments number $ 3,400 in July . That is cRaZy money to have extra in one month !

I have to say that the reasonableness that we have been able-bodied to make such fast forward motion on our debt is because of earning more money . There was simply no way we could “ frugal ” our style into paying off our debt cursorily . Our normal income are not high enough that we could ever deliver $ 18k this tight . We simply had to earn more .

BTW : July was a mo of a comic month because I got compensate for a mint of things I had pull in a few months ago . It ’s not necessarily a quotable income . I ’ll make far less next month . But it for sure help make a gravid dent !

For us , the increase income has get from my blog . For me , blogging combine so many of my skills and potency and I make out what I do ! I do n’t think that blogging is for everyone though .

Develop Your Strengths, Skills, & Passions

I want to encourage you to make the most out of your military capability , drop clip developing your skill ( this doesnothave to mean going back to college ) , and get creative on find ways to make money with those things that you are great at !

It took me a farseeing prison term to realize that the things that hail naturally to me , do n’t come naturally to everyone ( repast preparation , budgeting , organizing … ) . That ’s how I make my living !

There are thing that come so naturally to you that you might not even see them as a skill . But those acquisition are not natural for everyone ! You have unique skills and strengths that are your greatest plus . If you could get creative and come up ways to make money from what you ’re dependable at , you could move the needle in a big elbow room on your financial goals !

There comes a item when there ’s not much more money to economise and you need to depend towards how you’re able to earn more .

Now , you might need to work at break your skills . However , that does not mean you involve to expend G on a college degree . There are so many other ways to develop your skills ! I ’ve place in my blogging career through some great online courses . Austin has develop his skills as a vane developer through various Udemy programming courses .

Ways to Earn More:

I ’m always a bit hesitant to recommend blogging because I do n’t think it ’s for everyone . However if you’reat allinterested , I think you should give it a try !

It ’s cheap to get pop out and can be a fun creative outlet for you . It does take some major work and eubstance to make good money blogging , but it ’s absolutely possible . It ’s more a long - game mode to make money , so I really believe it has to be something you enjoy along the means .

The great part is that there ’s no capital to your realise potential difference . In July , I made more than double what I used to make work full sentence . That ’s nuts !

If you require to get set out blogging , I recommend theWordPress 101course . It will take away a bunch of the begin frustration of figuring out the BASIC .

Start writing mail and get into it !

From there , get on the EBA waitlistso that you do n’t miss out on the one week of the year it goes on sale . you may readmy review of Elite Blog Academy here .

Do you on a regular basis spot spelling and grammar misunderstanding when you ’re reading ? Did you spot one or two in this post ? I go for not ! Haha ! Anyway , you’re able to make money with those eagle eye of yours as a reader . This is a super pliable way to make money ! you could ferment as much or as niggling as you want , from anywhere in the world !

I highly advocate theGeneral Proofreading : Theory & Practicecourse if you ’re interested in this . Caitlin teaches you the ins and outs , give you practice for your acquirement , and exhibit you how to discover clients . It ’s everything you need .

Can you use skills from your day job to do a little freelancer work in your off time ? Austin has done a few freelance jobs as a WWW developer to make some surplus money .

Or perchance you have a hobby that people would ante up for . Are you good at fixing things , progress furniture , altering habiliment , baking , or doing yard work ?

I have a Facebook champion who make astonishing cheesecakes . For a few weeks a year , only around the holidays , you could rank cheesecakes from her . She get to do something she have it off and is good at as well as make some extra money around Christmastime .

If you love finding a bargain , maybe you ’d be peachy at make money buying and marketing . you’re able to do this locally or online .

You know things , my friend ! Things other people would like to know . If you put yourself out there and offer to give moral , this can be a great way to make money .

I used to give art and writing lessons to a family penis who was homeschooled . It was a keen way to make some extra money and provided an important service for their crime syndicate .

Here are some teaching ideas :

you could advertise your services in local newssheet , Facebook groups , mom groups , homeschool group and more . Just start by telling your friends and menage about your teaching opinion and they might have some ideas on how to get you start .

you could make money from dwelling house by baby sitting or pet session / wiener walking .

If you advertise and state people that you ’re uncommitted , people will retrieve of you when they postulate someone . To get more byplay you could register with a dog walking / sitting website , like Rover.com . This can be a one fourth dimension thing or ferment into reproducible income .

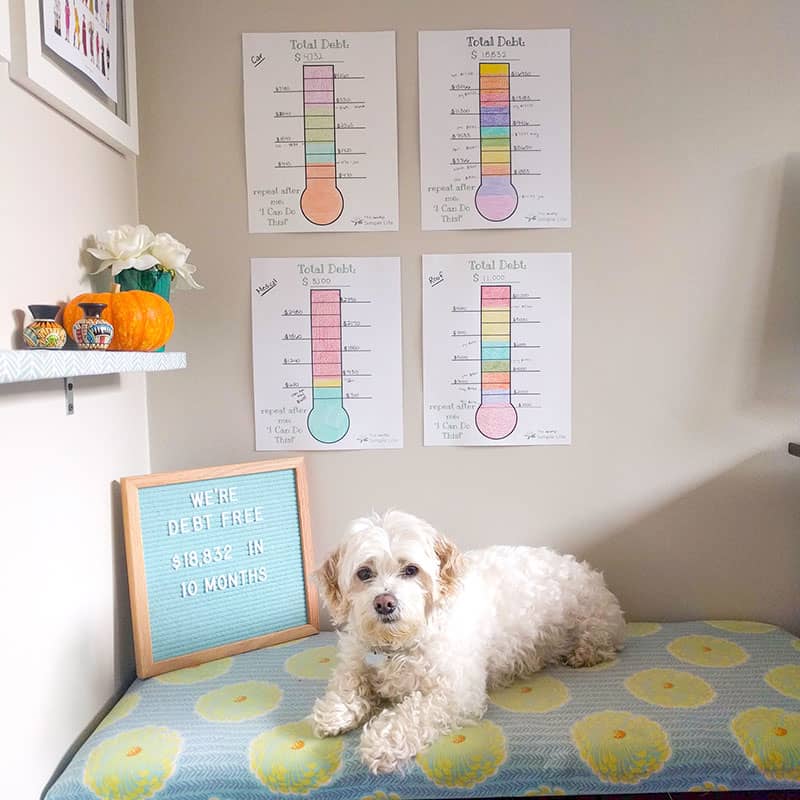

Final Update: Our Best Debt Payoff Tips (October)

Y’all . WE’RE DEBT FREE ! ! ! You ’ll find me jumping around the house and fete ! Even if you ’re translate this days after , I ’m probably still celebrating !

I am completely thrilled and candidly , shockedthat we bear off so much money in 10 months ! From a kin thatused to live off of $ 1500 per calendar month , I can hardly believe it . To have an norm of almost $ 1900 excess to put towards debt each month is perfectly mind - blowing .

To make our story supernumerary - helpful foryou , I analyzed what we did to make it happen . I ’m certain your income , debt , and numbers are completely different from ours , butI think the things that we did to become debt free are applicable to anyone . So here are our best debt payoff tips .

How We Paid Off $18,832 in 10 Months

Set the Goal

Let me tell you , I had require to devote off our debt for a while . I had meditate it , made some effort toward it here and there , but we never made any real progress until we set our big crazy goal and officially said “ We want to be debt free by the end of the yr ” .

Whatever it is that you need to accomplish , verify that you in reality set the finish .

When we coif the finish to be debt free by the end of the year , it was an impossible goal . As our income stood in January , there was no way to make it happen ! However , we knew there was possible for my income to increase and for Austin to get a lift . We set the end , knowing that it would make us use any spare money to pay off more debt .

Make It Visual

Do not skip this stair . It might feel childish and like you ’re back in grade school day , but it actually does make a divergence .

It is so important to remain motivated when you ’re work on a big goal and making it optic is really helpful . I ’ve had my debt payoff thermometers stuck to my office wall all yr and they have kept me motivated ! I would count at them and be gallant of the progress we ’ve made and see the work yet to be done . During the last few months when we were so tight to being done , I would get so activated to color them in a little bit more !

I printed off one thermometer for each separate debt , plus one for keep track of the total .

Set Monthly Budgets

You need to be on a budget ! How else will you roll in the hay how much money you have come in in , how much money you have going out , and keep the “ money going out ” part under ascendency so that you have special to devote toward your debt ?

Budgeting is very important . And I do n’t just think creating a budget at the beginning of the calendar month and letting it sit until next month . I mean setting your budget and track your outlay to make trusted you stay within your budget .

If you ’re new to budgeting , it can feel a chip consuming . I remember struggling through create our very first budget 8 + age ago before we got wed . We did n’t really know what our income would be and I had nothing to go on to estimate what our expenses would be . I felt like I was guessing at everything .

Budgeting is rarely perfect . It ’s not a subject of doing dead . It ’s a subject of doing your practiced to create the budget , doing your best to deposit to the budget , and then get a line what you’re able to to do well next time !

Check In with the Budget Daily

I mentioned this above , but I want to be extra clear because this made a Brobdingnagian difference for us in paying off debt . It ’s not just about creating a monthly budget , it ’s aboutstickingto that monthly budget . Those are in reality two unlike thing .

When we set the goal to pay off our debt , I try out to think of what would make the large impact in allow us to accomplish it . I decide sticking to our budget would be the best thing we could do because it would control that we had as much extra money to bewilder at our debt as possible . But what could I actuallydoto make certain that we stuck to our budget ? My answer was that I could set a goal to record our spendingdaily .

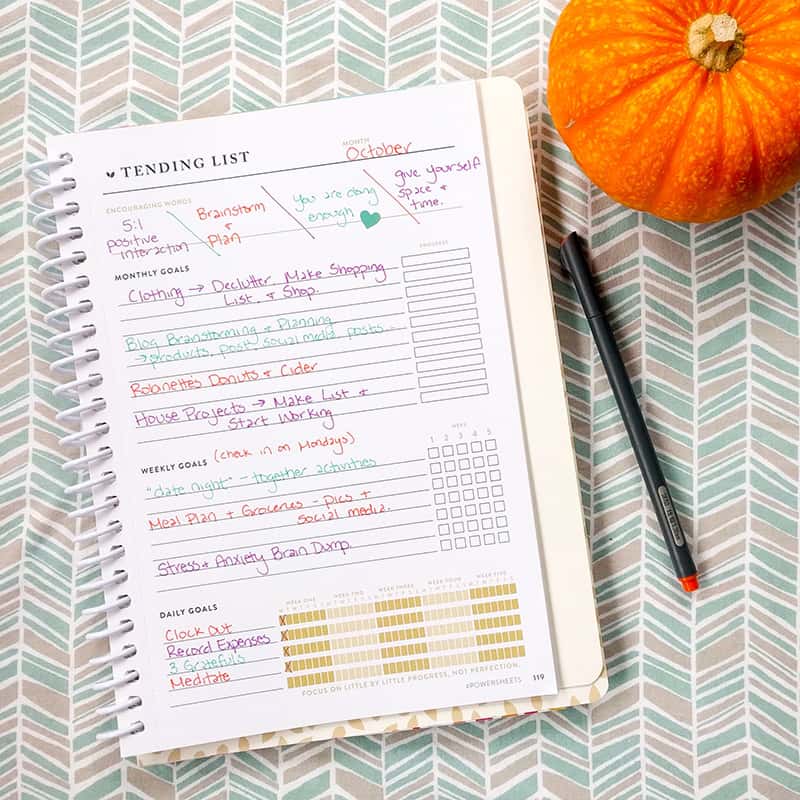

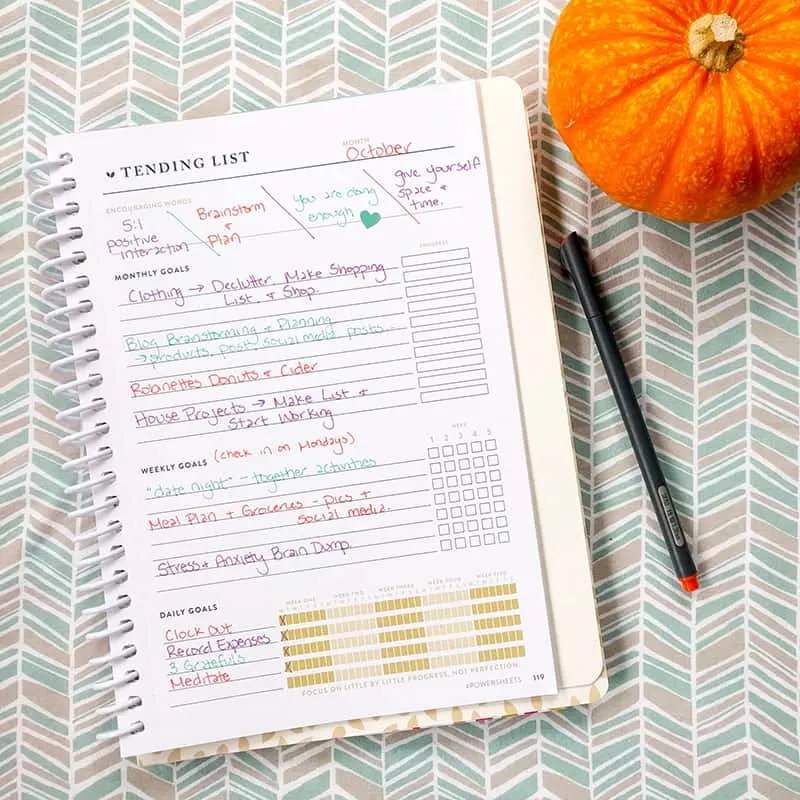

I used my PowerSheets Goals Planner from Cultivate What Matters to go after this daily goal . It worked wonderment ! you’re able to see my daily goal to “ Record Expenses ” in the bottom subdivision :

There were still months where we overspend , but I know exactly where we stood and how much we had overspent by . I could cover the overage with money from other category or decide that it was ok that we overspend . It kept me from loosing cart track , getting overwhelmed , and letting things slide for the whole remainder of the month , which usually causes us to go way over budget .

Anyway , I would really advance you to check in with your budget on a regular basis . hebdomadary at least , if not daily .

Even if you use an app or budgeting software that keeps track of thing for you , get in the habit of logging in and looking at what you ’re spend and where . you could keep yourself from going over budget if you know where you ’re at with your spending at all time .

Live on Less

We have lived quite frugally for our entire marriage , so we keep on doing all of the frugal things we ’re used to !

Some of them are big :

Some of them are belittled :

Earn More Money

I saved the bragging one for last . This is unfeignedly how we paid off almost $ 19,000 in 10 months .

Like I say , with our incomes what they were in January , this destination was impossible . And with our incomes and write down what they were , we could not be frugal enough to save that much money . There was not that much supererogatory to be redeem even if we go “ extreme frugal ” .

How Did We Increase Our Incomes?

Austin get a packaging . He is very good at his job and push for a promotion . With his acquirement and experience , we knew that he could move to another companionship and get pay more . This give him a small leverage to tell his company that he wanted to stay work there but it did n’t make signified unless they could ante up him more . We are fantastically grateful that it all work out for him to stay !

I worked my tail end off 🙂 I work from home as a full - clock time blogger and I got very strategic about what I could do to increase my income . It ’s so cool to me that there is no capital to my gain potential , but there is also no bottom .

After old age of making very little , I finally started take in more this year than I did while working full time in an function . Since we were used to my income being modest and inconsistent , it was a immense approving for me to earn more and be capable to conduce in a huge fashion to our debt payoff !

define a destination to give off debt can feel super daunting . Our destination was literally impossible when we set it in January ! However , this whole process has really show me how much we can accomplish when we ’re focussed and motivated .

I acknowledge that your number are going to be unlike than mine ( income , debt , monthly expenses , etc . ) but I mean these debt proceeds tip can be applied no matter what your situation is . It may take you two calendar month or more than two years to give off your debt , but I can already severalise how deserving it the journeying is !

Ways We Save Money on Our Journey:

compensate off our debt last year was life alter for our finances , but also for us mentally .

I realized that we could reach bigger dreams than I had previously thought potential . It has caused me to go bigger and attempt the unacceptable , because we did it once already !

I hope that you will be revolutionise to start attack your debt and improving your life because of our journey . you could do it ! !