This post may contain affiliate links . See disclosure in the sidebar .

I hate to say it but our financial situation has been a bit gravelly latterly . From my recent referee study , I know that a huge per centum of you are frustrated with debt and right now , I ’m totally with you .

For years we had no debt except for a mortgage . Without debt , we were able to keep our monthly expenses passing low which was a Brobdingnagian blessing to us ( take a look at our premature budget whenwe lived on $ 1500 per month ) .

Moving twice , needing a better car , buying a business firm , and medical problem have led to us give some debt again and I hate it !

Some of what I explain below is n’t quite debtyet , but I ’m adding it to the lean because we have it off it ’s add up and we do n’t have a manner to pay for it .

⇒ Sidenote : Do n’t leave out the free printable at the bottom of this post ! ⇐

Here’s our current situation and how we ended up here:

Car Loan – $7000

Our previous railcar kept take expensive repairs . We had already spent nigh to $ 1,000 on repairs in one year and the car was n’t worth much more than that . We lead out a gondola loan to buy a more authentic used auto with plan to pay it off directly . Then , we ran into the rest of the problems below . We still owe about $ 7,000 on the railcar .

Medical Bills – $6,000+

Austin end up in the infirmary in December and we ’re still see bills pop out up for this . In fact , we ’ve get an explanation of benefits that testify that a $ 5,000 handbill is still on it ’s fashion .

We also both needed dental work done since we had n’t been to the dentist in years .

We presently have health and dental insurance policy but it ’s just not embrace near as much as we had hope . We ’re trying to keep up with paying these bills as they come in but it means that we have n’t had extra money salary on the car loan . Plus , I know that $ 5,000 bill will be here before long . We ’ll see if we can work out a discount rate or payment architectural plan with the hospital for it .

Mozzie – $1,000

Mozzie ( ourbabydog ) just went to the veterinary and has some teeth problem ( what ’s with all of us needing dental work ? ! ) . He needs to get his teeth cleaned and have some removed which is super expensive for a dog since they have to be put under for it . We ’re not willing to put this off because it ’s understandably bothering him and could lead to other wellness problems . Plus , we ’ll get a modest discount rate through the vet if we have it done right aside .

UPDATE : We let the cat out of the bag to some Quaker and found a ex-serviceman that will do the procedure forhundredsless than what our veterinarian quoted ! It ’s about 40 minutes away , but well worth the trip . What a in force monitor to call around for quotes !

Roof – $13,000

So , I like to suppose of this as “ future debt ” . When we bought our house , we were told that a leak in the roof had been fixed . Since there was snow on the cap , nothing could be thoroughly audit . Long story little , the roof still leaks . It ’s a eldritch sort of ceiling that ca n’t really be repaired in small division , so we ’ll have to get a steel new roof , which we would n’t have been needed for a few years otherwise .

We ’ve got tar over the leak correctly now which we ’re hop will last us through the winter so that we can hold off on the ceiling until next fountain . We ’ve fuck off some quotes and it ’s going to be close to $ 13,000 ! We ’re stressed about it and want to save up for this ASAP but are ineffectual to do so because of the gondola , medical , and vet bills .

So that ’s the whole deal . It ’s frustrating and I want to get it all ask care of , like , yesterday . Unfortunately , it ’s break to take some time . Here ’s how we ’re tackling debt .

Record All Debts

The first gradation to receive out of debt is to record all of your debt . Write them all down in one spot so that you’re able to assess what ’s go on . Get it all out there .

Even if it ’s scary , it ’s better to cognise where you ’re at so that you may make a programme for how to handle it . The “ unknown ” is what ’s scariest .

I ’ve got a musical note on my desk that lists all of our debts and coming massive bills . It reminds me of where we ’re at and what we ’re battling against .

Plan Where to Put Extra Money

apparently , to get rid of debt you require to pay it off . have lower limit requital is go to take incessantly and you ’ll probably pay massive sum of money of interest .

After you roll in the hay what all of your debts are , make a plan for how you ’re endure to pay them off . You ’ll keep build minimal payments on everything , but where are you fail to put extra money ?

I care the plan of throwing all of your spare money at one debt until it ’s wholly gone . Then you’re able to amply center on the next one . There are two ways of move about this :

It ’s o.k. to use either method acting , just ensure that you have a programme so that when you have extra money you know right where to put it . As my mom always say , “ Plan the plan , work on the plan . ”

Our program is to keep up with our aesculapian billhook as they roam in . September is a three paycheck month for us , so we ’ll use that extra paycheck to fund Mozzie ’s tooth cleaning . Once we ’ve pay back all of the medical and vet neb handle , we ’ll start throwing everything we ’ve got at the auto loanword . After the machine loan is knock out , we ’ll have even more money per month ( without a car payment to care about ) to save as much as we can towards a new roof .

Stay on a Written Budget

So how do you go about give extra money to pay on your debt ? Well , I ’m glad you asked 🙂

You know I have to let the cat out of the bag about budgeting ! Specifically , take in a written budget . Budgeting in your mind does n’t count .

make a pen budget for every calendar month so that you know where you money is go and how much money you will have to put on debt .

If you postulate budgeting help , check out these posts :

Our Monthly Budget : live on $ 2500 Per Month

How & Where to Cut Your Budget

The fast Way to Create Your First Budget

Record Spending Diligently

To truly cling to a tight budget , you need to register your outlay . How else will you sleep with if you ’ve gone over budget ? you may apply a simple spreadsheet like mine . Sign up below to download and customize it for yourself :

[ convertkit form=4899234 ]

you’re able to also apply an app on your phone . I ’ve been using one called iSaveMoney recently so that I can speedily record receipts as soon as I get in my car . It really only takes instant and is n’t a big passel once you get in the riding habit .

Check Accounts Daily

I also recommend that you gibe your business relationship daily , or at least weekly , so that you always know where you ’re at .

Does this experience like overkill ? perchance , but you ’re more likely to have surplus money to devote on debt each month if you detain on top of your disbursement .

fit your accounts for any subscription or monthly fee that you forgot about . verify account are coming out in the same amount you thought they were . three-fold confirmation to see that you recored all of your expenses accurately .

Make Extra Money

We are seek to bump way to make more money so that we can pay off our debt . you may understand a bunch of ideas ( that in reality work on ) in this post:5 Ways to Make Money from Home

Austin is a programmer , so he is trying to piece up a side task that he can do from home in the even which will give us some superfluous income . I ’ve been putting in extra time on my blog to increase my income in that way . If you ’re interested in blogging , you could readwhat I wish I had known when I started .

Be on the lookout for way to make money , either from selling thing around the house , pick up an overtime duty period , or get a small part time job . It will all be deserving the cause once you ’re debt barren !

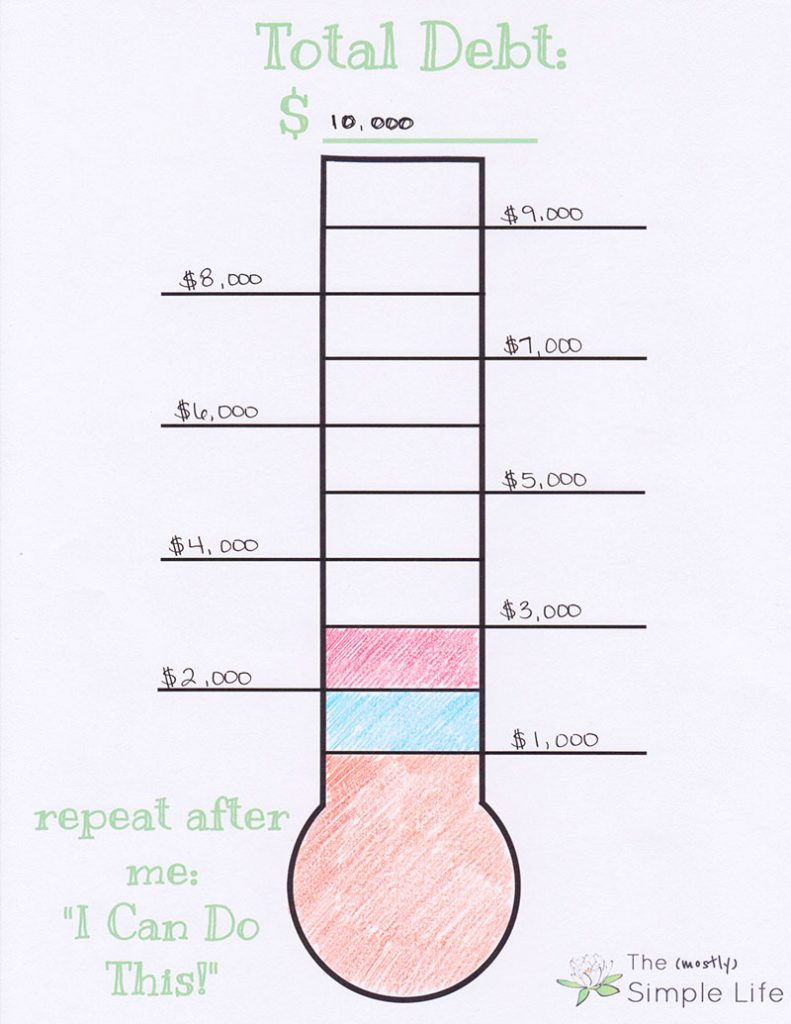

Track Your Payoff Progress –Free printable!

last , do n’t leave to track your advancement in a visual fashion . This makes it so much more exciting ! On day that you ’re frustrated , you ’ll be able-bodied to see how far you ’ve come .

model ⇓

I made up a special printable for you so that you could track your debt payoff progress . Just compose the total amount of your debt at the top , then divide that issue into small increase on the side and colour it in as you pay it off . You could also print a disjoined Sir Frederick Handley Page off for each debt and take them in that way .

Enter your name and electronic mail reference below if you want me to send you this free debt payoff tracker :

Start Tracking Today !

Powered By ConvertKit

I ’ve been stressed about money recently . My biggest motivation for bond to a budget has always been so that we do n’t have to stress about money . We ’re using these methods to take on our debt so that we can be in a much less stressful position as soon as potential .

I know how respectable it is to not have any debt and to not have to interest about being able to bear bills that come out up and I hope we ’ll be back to that presently .