This post may contain affiliate links . See disclosure in the sidebar .

After Ben and I got wed in 2014 , we were gain two income , but we also had debts , and part to have to pay for all those adult expenses that have a direction of syphoning out all your money . So I taught myself how to make our own budget DIY , translate our expenses and lay aside more money . With our first budget , we understood why we were capable to salvage only ~$40 - 50 per month .

From Living Paycheck to Paycheck to Saving Money

We used to live paycheck to payroll check , putting very little money aside . However , over the years , I have amend my budgeting skill and was capable to learn on the nose where our money was snuff it . We were eventually able to pay off most of our credit cards ( over $ 15,000 ) ; purchase our house as well as a rental property ; save enough money to live a comfortable spirit . I am well cognizant that it can find impossible to start out budgeting when you ’re trying to estimate out how to stop feeling like you ’re drown in your bill and you may barely cover your monthly disbursement . That ’s why I started to write about our own personal experience so that ( hopefully ) other people can check from it .

Our First Budget

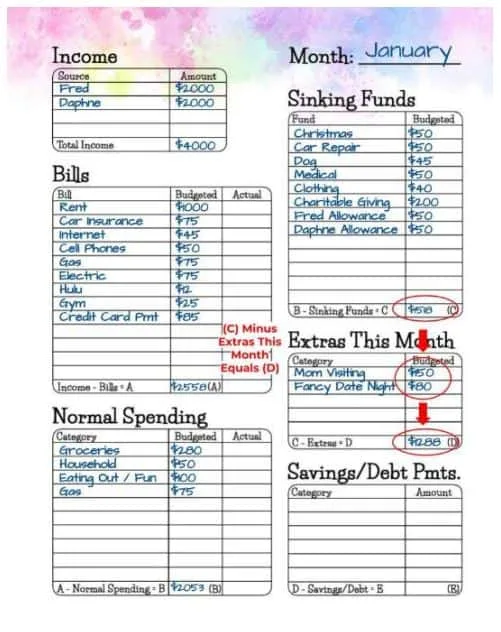

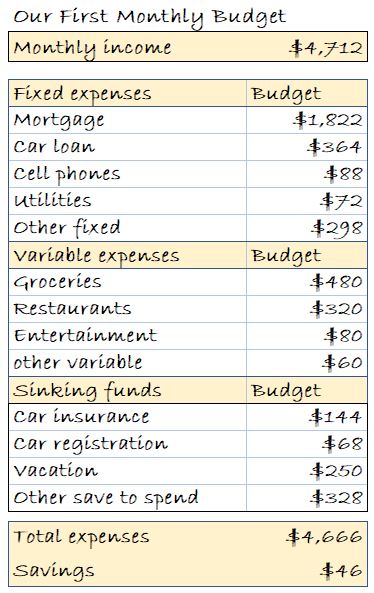

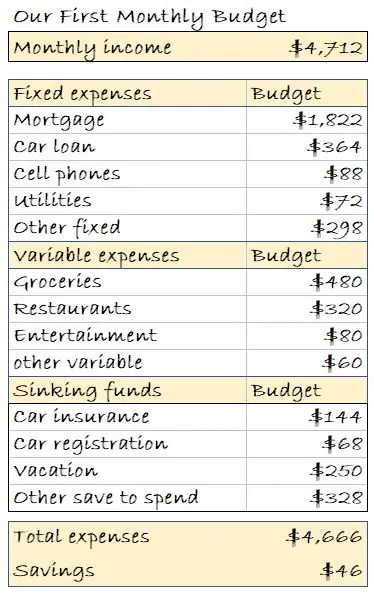

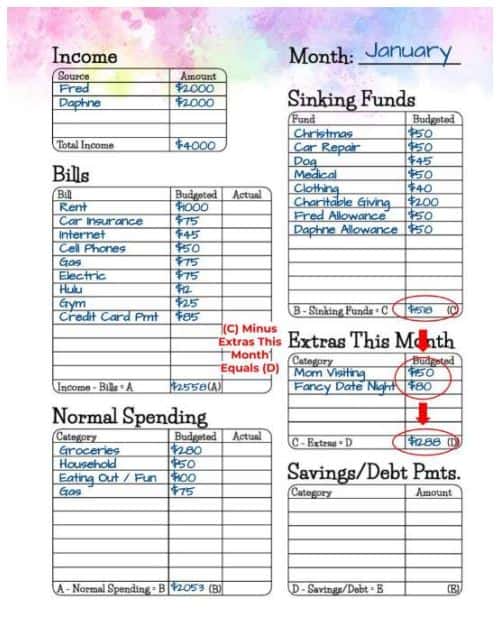

Below is the FIRST budget I put together for Ben and I. The image below is a simplified version to interpret on a mobile phone .

I used an Excel spreadsheet and classified all our expenses in three buckets : “ fix expense ” ( the amount is roughly the same every calendar month ) , “ Variable expenses ” ( disbursal change month to calendar month ) and “ Sinking Funds ” ( Big expenses happening once in a while , such as a car or menage haunt ) .

And , ooops , as you may see on the persona above , our deliverance wereonly$46 per monthin this first budget ! Our budget exercise intelligibly explicate why Ben and I struggled to keep our bank report afloat and could n’t pay down debt faster .

So countenance ’s see now in more point how we create our first budget , with our testimonial on how to get this whole physical process started .

4 simple steps to make your first budget

I will examine to make it as simple as potential . How can you get begin with your first budget ? I put together this step by step guide so that is as comfortable as possible for you to make your first budget :

1. Start with Your Expenses

You must first stocktaking all your expenses . And i mean all your expenses . It does n’t weigh if you ’ve paid for them by credit entry card , debit entry circuit board , check , Apple Pay or even by hard cash . So how do you do that ?

Start small . What matters is that you get pop . you could usa dim-witted notebookor anexpense tracker . you’re able to view / download myExpense Trackerif you desire to use an disbursement tracker printable ( see screenshot below ) . If you need a bit of supporter to figure out how to get a listing of your expense from your credit lineup or bank building bill , read our article : How to get your expense from your online recognition card or banking accounts .

The outgrowth of pull together all your expense usually take time ( about 1 - 2 hours ) but it is critical to help you read exactly how you spend your money .

2. Decide Where You Will Keep Your Budget

Once you have a record of all your expenses , you will be able-bodied to make your first budget . The next footprint is to decide where you are going to keep your budget .

If you are a information processing system person , you will probably want to use an Excel or Google Spreadsheet . If you are a pen - and - composition someone like me , you’re able to use a bare paper budget . Here are the primary options : :

you may also list your “ sinking stock ” , which are expenses that do n’t happen every month but have a big impact on your finances in any establish yr ( For example , railcar repairs or Christmas gifts ) . It ’s very important that you have a list of sinking funds so that you do n’t get any defective surprise . You do n’t want bad surprises with your finances !

Ok , now that you have it off where your budget will live … on to produce your budget !

3. Write Down Your Budget Categories

It ’s clock time to inventory all your “ budget class ” , such as grocery , cars or eatery .

Most budget category will contain several type of disbursal . For example , the “ motorcar ” budget category will control gas , car repair , tyre replacements , oil changes and even parking or speeding ticket ( we never get those ! ! ) . There are a peck of different kinds of budget categories so you want to verify you do n’t miss the large 1 . A budget will only solve well if it ’s COMPLETE .

I ’ve listed below the categories used to create our own budget :

Housing

Cars

aesculapian

vacation

Obviously Christmas and Thanksgiving , but do n’t block Halloween , Easter , and Valentine ’s mean solar day too !

Birthdays

![]()

Once or Twice Per yr Costs(Great for yoursinking finances ) .

Kid Stuff

Clothing & horseshoe

![]()

Charitable Giving

Gym / Fitness Class Fees

haircut

To check more about budget categories and make certain you did not forget anything of import , condition out Christine ’s post on55 Budget Categories You Do n’t Want to Forget .

4. Assign a Dollar Number fo Each Category

For each budget category , you should designate a number – how much you ’ve spent , per week or per month , for each “ budget category ” . utilize your best estimate for each family , track down yourreceiptsor review yourcredit card expense or bank account expenseshistory . survey all your expenses for the past 2 - 3 month because not all expenses will occur every month .

How do you account for rare – but big – expenses like a car repair ?

Those expenses are list in the “ Sinking Funds ” category in your budget . For “ Sinking Fund ” disbursement , I part up the estimated one-year outgo into small sum that I fund each month . For good example , for “ Car Maintenance , ” I recognise that I wo n’t have to have my railway car worked on each calendar month , but it will be costly when it get around down or need maintenance . So , I congeal aside $ 110 each month to fund it easily when I need to . This mean that yearly I put $ 1320 into my “ Car Maintenance ” sinking fund / budget .

Once you have done all this ( not so fun ! ) grunt work , you are quick to reap the rewards .

5. Start Saving!

Now that you know exactly how much of your money is being spent , and HOW it is being spent , you’re able to take mastery of your finances . With your budget , you now know exactly how much you are expend per category and where you should cut . I advocate get going by place a “ budget amount ” ( maximum allowed spending ) for some of your top categories where you recognize there is way to snub . Set a number and stick to it .

For model , I recommend that you set a target for “ grocery store spending ” and go shopping with that number in mind . It will help you make smart alternative and motivate you to spend LESS . You will suddenly regain new waysto save money on groceriesbecause you will be motivated to meet your budget destination , and because it feel great when you do so .

If you go over budget , you know you need to make it up next meter you go shopping .

you may also brainstorm with your better half or friends novel ways to cut disbursal on your top - spending class . Read our post onhow to use a budget to preserve an excess $ 5,000 per yearto get some intake .

If you are ready to take it to the next step , you’re able to also review ourbest budgeting tipsto take it to the next level .