This post may turn back affiliate links . See disclosure in the sidebar .

I know most mass do n’t get worked up about redeem for retirement and I used to be one of them . But I ca n’t wait to partake what I ’m about to share with you ! No lies .

What if you could save for retirement without noticing ? And what if it was completely painless?As in , you scarce noticed it was hap and it did n’t interchange your budget . That could be a game record changer , my friend !

There have been many years where we had zero extra dollars to save for retreat . Zero . Sometimes we ’ve been capable to contribute to a 401(k ) , other times we did n’t have that available to us . We have some retirement savings , but not the amount that the pros say that we should have by now .

So , while we currently are contributing to my husbands 401(k ) and I recently prepare up machinelike sedimentation to my Roth IRA , I ’ve also been on the lookout for how to beef up our retirement savings .

And this is why I ’m so excited ! If this service had been around back when we were totally bump , I think we would have been able to save more for retirement pretty painlessly !

It ’s call Acornsand what they do is round up your purchase and invest the trim alteration . So say you spent $ 11.37 at Subway , Acorns round off that up to $ 12 and invests $ .63 in your IRA .

You link your checking history , debit entry card , or credit card to your Acorns bill . Acorns virtually rounds up each purchase you make to the nearest dollar mark . When your round - ups reach out $ 5 , they transfer the money out of your “ funding reference ” account ( whichever score you told them to take the money from ) into your investing account with them .

You choose how you want your money invested , which they make super easy for you . They will advocate one of their portfolios for you and then you could change it if you want to . There are five portfolio choices ranging from conservative to aggressive investing .

It ’s all so well-off and automatic and you hardly notice a thing because you ’re just assail up each purchase .

Set Up Your Acorns Account Here.

How Much Have We Saved?

In our first month of using Acorns , we saved about $ 45 for retirement ! This was spread out over 82 transactions . I do n’t expect that we will preserve that much every month because we had some reasons to patronise a lot more than normal during that calendar month .

And I really did n’t notice it materialize ! As I spent money throughout the calendar month , I just assail up my purchases to the next dollar sign as I read them in my budget . So when I went to commemorate our grocery spending , I wrote down that we expend $ 63 instead of the real $ 62.85 .

Projections

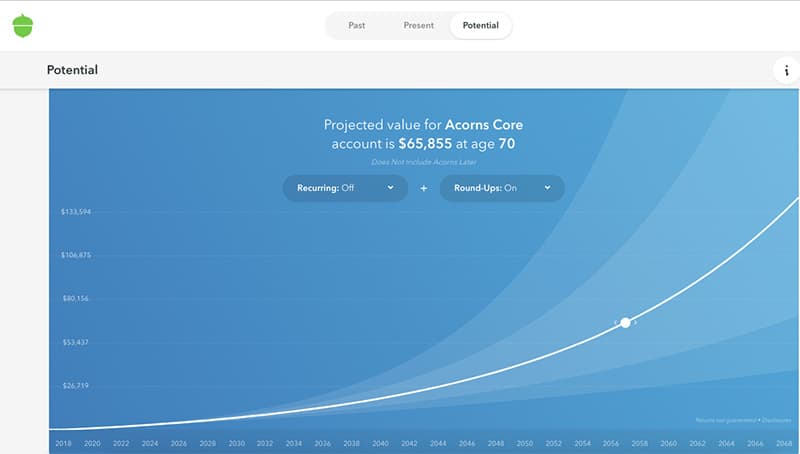

Based on the investment funds portfolio you choose and your average savings each month , Acorns shows you the design value of your account by the time you reach retirement age .

decent now , my chronicle sound out it will be worth closely to $ 66,000 by the time I ’m 70 ! Not bad for save my spare alteration !

Is It Enough to Retire On?

Just saving your free change with Acorns is not exit to give you enough to retire on . BUT , I think can be a ace smartpartof your retreat planning !

I ’m sure that I ’ll be able to fall up with something to do with my potential $ 66k when I ’m retry , do n’t you ? And for being able to save for retreat without noticing , I ca n’t think of a good reason whynotto do it .

If you do want to save more than just your orotund - ups , you could set up other recurring deposits as well . You could add an additional $ 5 per week or $ 200 per month . It ’s up to you .

you’re able to also position up a multiplier on your unit of ammunition - ups . If you set up up a 2x multiplier , the $ .30 you were sound to gift on a round - up gets double to $ .60 .

sink in here to get a line more about Acorns .

The Fee

All retirements investment have fees of some sorting , and while I am emphatically not a financial pro in any way of life , I ’ll excuse the Acorns fee as best I can .

The Round - Ups feature is part of the the Acorns Core story , which cost $ 1 per month .

From other fiscal critique I ’ve read , the $ 1 per month price is a bit eminent as you ’re starting out since you many only add $ 10 - 20 to your news report in your first month ( though I added $ 45 in my first month ) . As you total more to your account through the month , the $ 1 fee becomes a better and better distribute if you look at the portion of the fee versus how much you have indue .

Here ’s what I think:$1 per month to be capable to mechanically and painlessly save my spare change is absolutely deserving it to me . I can pass $ 1 per month on a lot stupider stuff and nonsense , so it does not trouble me at all that as I ’m first starting out the percentage of the fee versus my account value is a little rough . It ’ll only get effective the more I bring through and I love how easy this savings method is !

Who Is Acorns For?

I make out it ’s obnoxious to say that it ’s for everyone , so I ’ll get more specific ( even though I consider it ’s believably a good melodic theme for anyone with ten or more years left until retirement ) .

I dead have sex how simple and easy Acorns makes it to write for retreat without noticing . It can be painful to see century of dollars come out of your news report each calendar month , and it might not be potential at all if money is rigorous . But rounding up each purchase and investing the spare change is completely doable .

I only care that Acorns had been around years ago ! There were many years when we did n’t save a thing for retreat , but I guess we could have handled rounding up our purchases and saving the spare change . Now , even with our other investment , I like knowing that we ’re doing a picayune extra to prepare for our future !

Click Here to Get Started with Acorns Round-Ups!