This station may check affiliate links . See disclosure in the sidebar .

We became debt free last year , but in truth we had been debt free before ! We ’ve been in and out of debt a few times over the years , and let me tell you , I much prefer to beoutof debt .

There are three constituent that have help us outride out of debt . When we did n’t have all three of these elements in place , we often ended up back in debt . So let ’s get into the elements you’re able to put into place that will assist you delay out of debt !

Sidenote : If you are currently in debt and want a step by step design for how to pay up it all off , I recommend that you start with readingThe entire Money Makeover .

How to Stay Out of Debt

Have An Emergency Fund

If you have a aesculapian emergency , heavy car problems , a leaking roof , or a chore departure , you need to be ready for it ! You may not know precisely what the emergency will be , but you know that emergencies do encounter . And each of those emergencies I just mention can well put you in debt .

We get going into debt a few years ago because the house we had just purchased by chance want a new roof . We had an emergency investment trust at the time , but it was n’t big enough to handle a unexampled roof .

An emergency fund that is big enough to cover three to six calendar month ’ Charles Frederick Worth of disbursement is recommended , but frankly , anything helps ! Five hundred to one thousand dollars is an excellent start and will keep you from acquiring diminished debts that can add up and overwhelm you .

If you want to remain out of debt , make certain you ’re save money in an pinch fund !

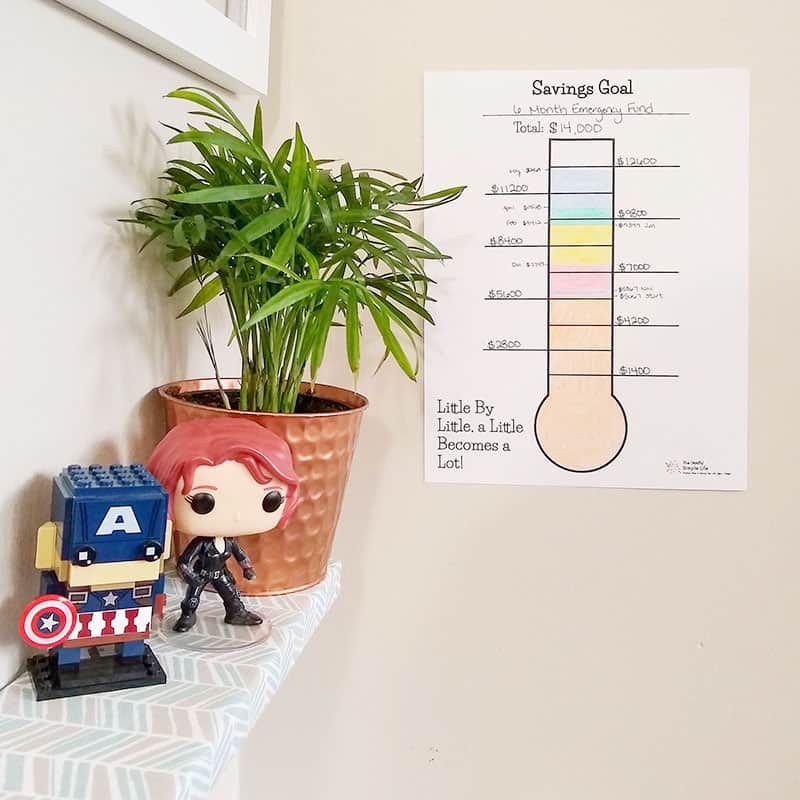

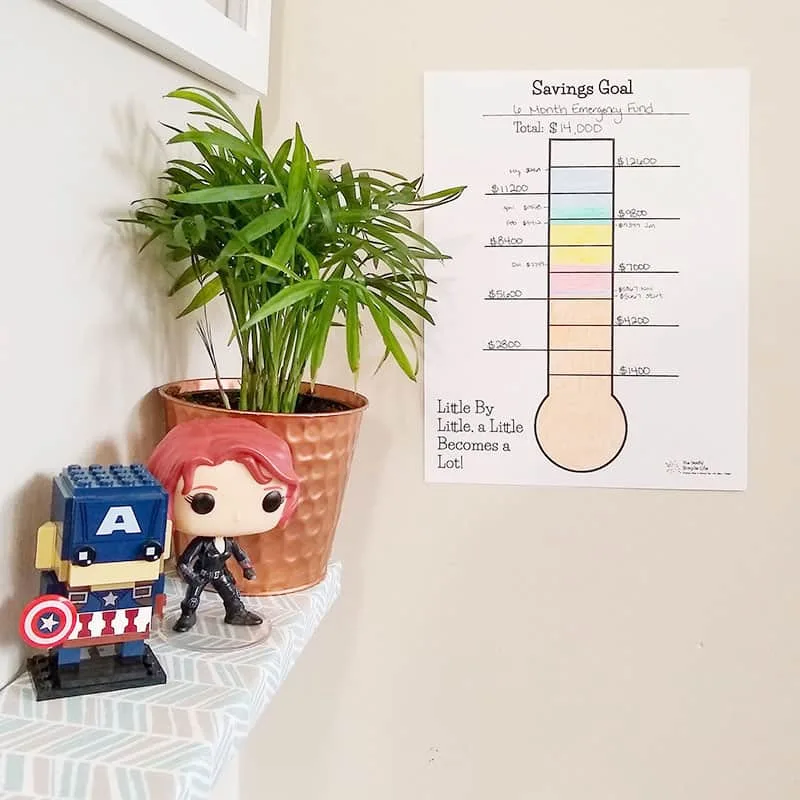

I love having a way to see the financial goals we ’re go on . As we were saving up our emergency fund , I tracked our procession on one of my thermometer printables . you may download my free thermometer printables when you enter your info in the shape below :

[ convertkit form=834534 ]

Use Sinking Funds

There are mountain of expenses that issue forth up that are not emergencies at all . They can be plan for and saved up for in advance of time . To stay out of debt , we use lapse investment firm to gradually save up for large expenses that we sleep together are come .

you could save up for Christmas expenditure , a young car , automobile hangout , birthdays , Modern dress , one-year bills , etc . — all of which can induce debt if you ’re not fain for them .

Another one of our debts was because of our needing a newfangled ( to us ) machine . If we had been saving money in a sinking fund each month , we would n’t have depart into debt for a gondola . We knew our machine would n’t last us much longer , but we still were unprepared for the disbursal .

![]()

I ’ve get under one’s skin a whole portion more information about sinking funds if you require to memorize more : way to set up up your sink funds , plusall of the sinking fund categories you may require to use .

Get On a Budget

How do you go into debt ? You spend more than you earn . So it makes sense that to stay out of debt you require to make certain that you are n’t doing that !

A budget will avail you plan how you want to drop your money , and track your disbursal so that you do n’t pass more than you realise and go into debt . It ’s as mere as that !

Creating a budget does n’t have to be super complicated . verify to bet at the posts below for all kinds of budgeting help that will get you set out !

![]()

I ’ve got a barren printable that you could use to start tracking your spending today ! Enter your info in the form below to snag it !

[ convertkit form=980628 ]

Having an emergency monetary fund , drop down cash in hand , and a budget in place will assist you stay out of debt in the future tense . I recommend that you utilize all three of these .

From experience , I know that when we ’ve been miss one , we were in peril of go into debt . mighty now , we have all three elements in place and I ’m convinced that we can stay out of debt !