This post may hold affiliate links . See disclosure in the sidebar .

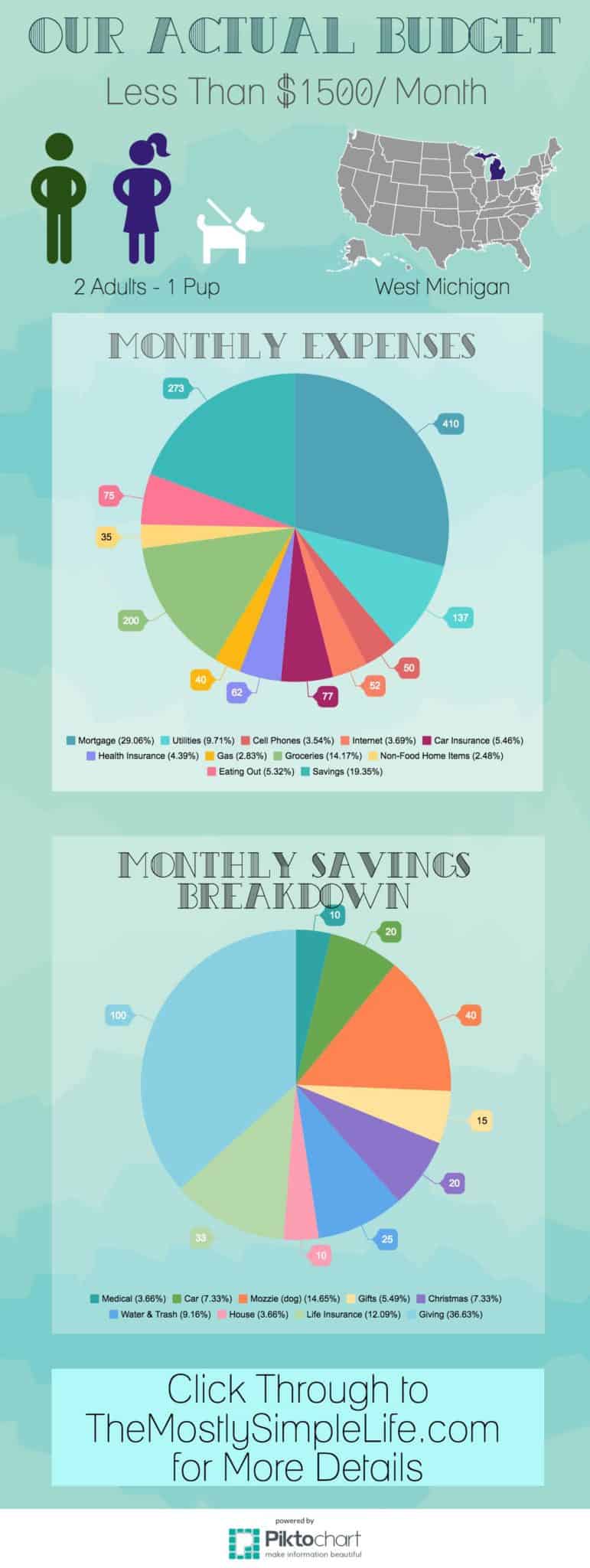

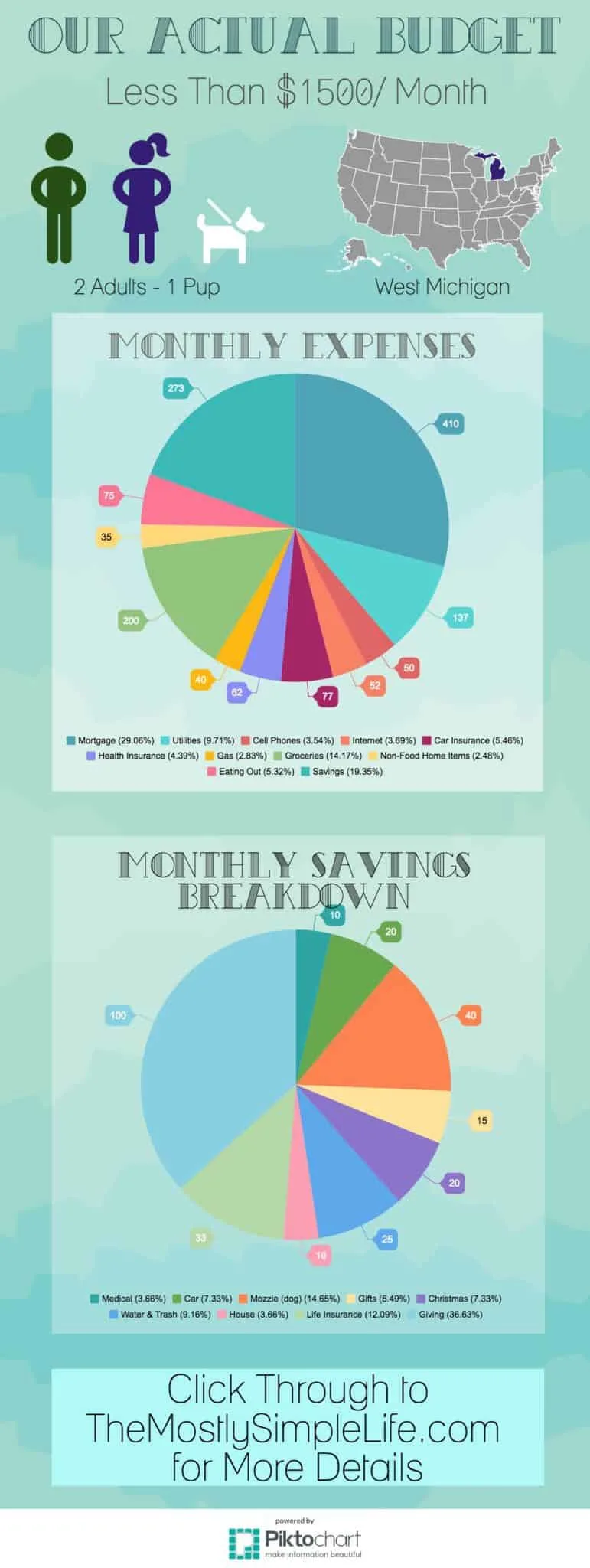

Today I ’m partake in what our mediocre monthly budget search like and how we survive on less than $ 1500 a calendar month . Eeek ! I ’m a morsel nervous .

I ’m not apportion this because I intend it ’s potential for everyone to live on how much we do .

Obviously , some parts of the earth are more expensive than others and there are wads of other constituent , like mob size , hobbies , and health concerns to take into write up .

I ’m deal it in hope that it might inspire you to find ways to thin out sure parts of your expenditure and because seeing how we handle our money might give you ideas of how to wield yours .

NOTE : Our budget has change since I originally wrote this Charles William Post in 2016 . Our budget looked like this for about 5 years . If you ’re interested in our current budget , you may read abouthow we be on $ 2500 per month .

One of the very best things you could do to start out getting a hold on your finances is track your spending ! you may download and print my free spending tracker printable and take natural action today !

If you are searching for ways to cut back , this book was a huge inspiration for me when we first got marry and were dwell on an even cockeyed budget : America ’s Cheapest Family .

If you are struggle with debt , budget , or bear your bills , I extremely recommend readingThe full Money Makeoverby Dave Ramsey . He lays out a step by step architectural plan for getting in control of your pecuniary resource and becoming debt free .

Some Basics About Our Budget:

Our budget is for two grownup and one spoiled puppy .

We live in a very small cost of living arena in West Michigan .

Our house defrayment is crazy - low ( yes , that figure includes tax and insurance ) , for which I am grateful every single day . We purchase a foreclosure home when cost were low and we had help from a local nonprofit to make the house livable .

We could have well drop more , but we had make up one’s mind that it was really important to us to not overspend on housing . We want a payment that we were comfortable with . Check out my post aboutthe # 1 mistake you do n’t want to make when buying a star sign .

We do n’t have a car payment and we yield our credit card off entirely every calendar month , so no debt payment there either .

Our budget stays relatively the same month to calendar month because we have separate , mini savings funds for irregular bills and expenses that we put up a little into monthly .

If we make more than we need for our regular monthly budget ( we usually do ) , we decide how to drop / save the extra money : retirement fund , beefing up our mini delivery funds , pass on something we want …

Mortgage: $410.00

We determine to buy a foreclosure home when prices were crushed and we had help from a local nonprofit organization to make the sign of the zodiac livable .

Electric: $91.00

On a budget plan to keep it the same every month .

Natural Gas: $46.00

Cell Phones: $50.00

We each have a super canonic “ non - impudent ” cellular phone phone . No texting program , no datum plan . It saves us a TON of money .

Internet: $52.00

Car Insurance: $77.00

We partake one car which also saves a ton .

Health Insurance: $62.00

High deductible insurance .

Gas: $40.00

Groceries: $180.00 or $45.00/week

If you look below , you will see that we also have a mini preservation fund for groceries for our every - couple - month trip to the “ big city ” to stock up on heart and non - perishable at Sam ’s Club and Aldi . So we probably average about $ 50 - 55 / week on grocery .

repast planning is one of the most important things we do to save up money on grocery . you could get the hebdomadal meal plan printable I use each week by entering your info below !

[ convertkit form=830245 ]

I useIbottato get money back on our food market . They even have rebates for fruit , veg , and store brand detail ! You canget $ 10 added to your accountwhen you redeem your first rebate . I ’ve even created atutorial for on the nose how I savemoney on fruits , vegetable , and non - name brand foods .

Toiletries: $35.00

Our grocery budget is for solid food only . This part of the budget is for everything else like makeup , toilet newspaper , cleaning supplies , trash bags …

Eating Out: $75.00

This is the first plaza we cut back if we need to , but we really like to get takeout and go out 🙂

Extras: $15.00

This is just a mini - buffer for if we need something picayune : like if one of us needs new wind cone or we ca n’t legislate up on some after Easter candy deals .

Monthly Deposits to Sinking Funds:

To keep our budget relatively the same every month , we stick money each month into multiple saving account so that we are n’t caught off guard duty by irregular throwaway or expenses . you could read more about how this work in these posts :

They allow you to have up to 25 disjoined savings accounts . you could dub your accounts to match with your chosen category and have money automatically deposited to each account as regularly as you want .

I contrive our budget monthly , so I have money automatically bring to our account on the first of every calendar month .

I have used Capital One 360 for year now and these savings accounts have helped our budget immensely . Plus , they give you a 1 % pursuit rate which is way good than our regular banking company .

Here’s what gets deposited into our sinking funds each month:

Grand Total: $1431.00

That ’s our basic “ bare bones ” budget evince how we live on less than $ 1500 a month . Like I said earlier , we usually make supererogatory money each month . If we do , we adjudicate how we need to spend or save it .

I hope our budget might give you a little hope or inspiration if you ’re endeavor to experience on less .

Related Posts:

Feature image background from Vecteezy.com