This Charles William Post may contain affiliate nexus . See disclosure in the sidebar .

For most of the eight years Austin and I have been married , we have had to live on one income . Even now , with Austin make for full time and my blog reach me a full time income ( most months ) , we really only use one income to budget off of month to month .

It for sure has n’t always been well-situated . The biggest reason that we ’ve been capable to be on one income is simply because we ’ve planned our life sentence that way .

Being able-bodied to live off of one income did n’t just chance . It ’s been potential because of a whole bunch of choices we ’ve made along the way .

you could do this too ! give the crazy - high cost of living in certain cities , it might not be feasible to subsist on one income , but I ’ll bet you could make some choices that allow you to live on less .

It may take some rethinking of how you do thing and some sacrifice , but being able to live on less has allowed us to do some moderately awesome things , as you ’ll see .

Let’s Talk Lifestyle Design

I just see the condition “ Lifestyle Design ” recently and I agnise that it is the perfect means to describe how we ’ve been able to survive on one income . In basic full term , lifestyle design is making choices that design your biography so that you could achieve your goals or survive the way you want to live .

We need to check that that we only needed one income to survive ( becasue most of the time that ’s all we had ) , and we ’ve made selection over the year that made that possible .

hoi polloi often employ the term lifestyle invention for the great unwashed who need to live exceedingly frugally to retire early or multitude who decide to exist off the grid . These lifestyles go against the normal manner of doing affair and demand you to correct your life up in a special way so that you could live how you want to live . I hope that make sense !

Housing

Price

If you ’ve seenwhat our budget used to looklike back when we lived on less than $ 1500 per month , you know that we had atinymortgage at our first planetary house .

Yes , we be in a part of the US that has a low cost of living . Absolutely . But I will also recite you that we basically bought the least expensive planetary house on the market in our town that was inhabitable . We easily could have expend double or more .

A mortgage is a long - term disbursement , and overspending means that you ’re stuck with a high requital for 10 . I was terrify of this , so we made certain to outride within a comfortable cost range .

We move to a adult metropolis when Austin finished school in 2016 ( there were zero technical school line of work in our tiny townspeople ) .

Bigger metropolis = More expensive city . Our income had increased , but so did the cost of the sign of the zodiac !

Again , we made a conclusion of how much we felt comfortable spending and vex to that even though it sternly limited location and home plate choices . It was a set harder in a bountiful city to find a neighbourhood that was conveniently locate , safe , and low-cost for us .

Location

pick out the location of our houses cautiously has also played a big role in allowing us to dwell on one income . As I ’ll excuse more in a second , we ’ve only ever had one car .

Our first sign was in the midsection of township and within walking aloofness to most of the occupation we ever had in that Ithiel Town . If we had buy a house out in the res publica , it would have made owning one car more complicated . selection , right ?

I loved that Austin and I always had the alternative to walk or wheel to work . If Austin had the auto , I could walk to shop or even to a doctor ’s appointment if necessary .

While our current mansion ’s location is not near as walkable as our old theater , we made trusted it was within 15 minute of arc of Austin ’s work to make car share-out possible .

Jobs

With jobs , we ’ve always made sure that we could make a job work while only have one gondola .

fundamentally , this has just meant that we ’ve made an effort to apply for occupation nearby . If Austin already needed a car for his current line , then I did n’t apply for jobs that would require me to have a car .

Back then , any occupation we had were not paying enough to warrant the cost of own two cars . This was all while we experience in a very small-scale town and walk or biking to most part of town for work was doable ( even though it sucked in the winter ) .

One Car

Notice I keep bring up the one elevator car thing ? It ’s been a huge money recoverer ! Not only do we only make up for insurance , gas , and repairs on one vehicle , we ’ve also never had the up front cost of purchase two vehicles .

This has certainly not always been commodious . That ’s the point of this post though , really . We ’ve made a choice to live off of one income , which has had huge benefits for us ( get to that part before long ) , so we ’ve get hold way to make thing work out . It ’s a choice .

Right now , I work from home and Austin definitely require a car to get to work . On days that I need the car , I have to shed him off at work and pick him up so that I can have the elevator car for the day . Yeah , it ’s annoying . I endeavor to compound any appointments or errands that have to get done and only do this about once a workweek .

Choosing to buy a house within 15 minutes of his job aid make this possible . If he had an hour long commute , there ’s no way I would drive him to work and go get him .

Frugal Living

We live very frugally . In the former years of our marriage , there was no other choice!We exist off of less than $ 1500 per month(one income ) and if I budget super cautiously , we ’d have $ 20 left at the remainder of then month to put into delivery .

We ’ve for certain been able-bodied to make relaxed a lot since then , but we still have our frugal habits !

Austin backpack lunches to bring to work most days . We only go out to eat once or twice a week . We DIY most of our family labor . I meal plan and shop at Aldi for groceries . We each get only $ 20 each for merriment money / allowance each month . you’re able to see what our current budget look like here .

Once you ’ve designed the bountiful parts of your life : planetary house , car , and job , it really comes down to go frugally with all of the little things .

You Might Like These Posts Too :

Using Extra Income in Life-Changing Ways:

Now the exciting stuff ! While for most of our married couple we ’ve only had one income ( we ’ve each taken turns bringing home the bacon because of the other person ’s health problems or education ) , there have been period of having two income .

Since we were so used to live frugally on one income , I attempt to verify we used the “ surplus ” money for something good — somethinglife changingfor us , in reality .

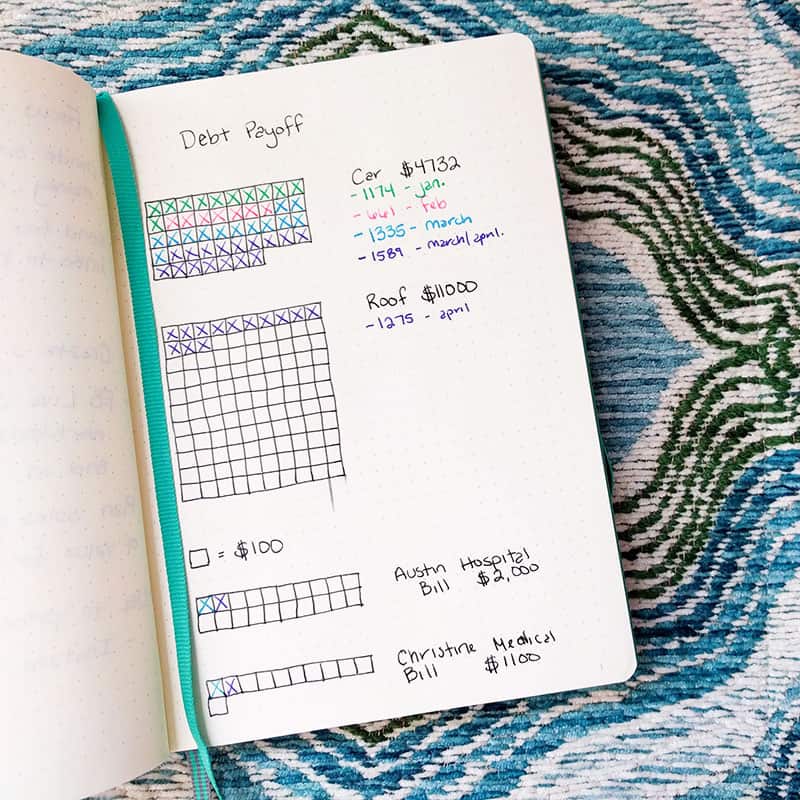

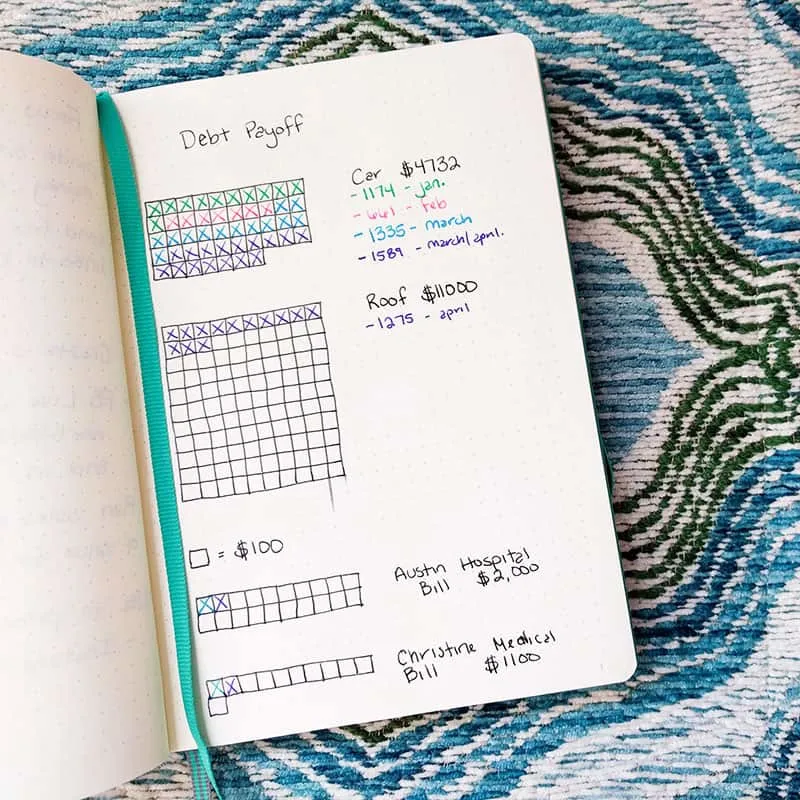

Paying Off Debt

Right now , all of my income is going to compensate off our debt ! you’re able to read all aboutthe kickoff of our debt free journeying hereandthe latest progress composition here .

We are rush to pay off our debt so that we can start working toward a dream that we had as newlyweds : to own a house on a lake by our 10 year anniversary ( we just celebrated 8 years ) . Once the debt is payed off , we will start save with child time to make this happen !

Cash for College

The previous time we had two full - fourth dimension incomes was in 2015 , I call back . I had been work an office job and Austin engender an great pay union job at a factory . The job was , he hated it . The only in force part was the earnings !

We decided to use his income to carry through as much money as we could so that we could pay cash for him to terminate college . We bring through up thousands before he quit and went back to schooling full time .

This was one of the most life - change pick we ever made . He bonk what he does now which has had an fantastically positive impingement on our fellowship .

If we had start living big with both of those income , he would have stay on to hate his problem and never gained the cognition and skills that led to his life history . Life changing ! Short term sacrifice has led to a burnished future for us !

( How cute is Austin ’s college graduation cake ? 😂 I thought the normal ones were boring , so I went the Toy Story cake ! )

Emergency Fund

We ’ve also used two incomes to create our emergency fund . Remember how I said I was thrilled if I could put away $ 20 per calendar month ? It was dumb going to save up three - six months ’ Charles Frederick Worth of expenses . I kept doing the good I could , but what really helped were the time we had more than one income .

That financial security measures we felt at having an emergency fund was well deserving it !

By living off of one income for eight years , we ’ve been able-bodied to accomplish some reasonably astonishing things , even with a small income . make up off debt , pay for college for Austin , and saving an emergency fund have been some life changing accomplishments for us .

When there was n’t any additional income to do big things with , we were still capable to live comfortably because of the wise decisions we made about our chore , lodging , and other expenses .