This post may contain affiliate link . See disclosure in the sidebar .

I ’m judge hard to stick to our budget these days because we ’ve got some big goal we ’re working towards .

We ’re go on to save as much as we can for our next house . We ’re suppose to fill up on the house in a few weeks ( yay ! ! ! ) and besides paying our down defrayment and closing cost , there are a few extra expenses we know we ’ll have right away .

Plus , we finance a used car at the destruction of last year ( which I really did n’t want to do , but we were having expensive problems with the vehicle we had ) and I ’m uneasy to commence pay that off .

In an attempt to contain myself more accountable , I require to post a budget revaluation for the calendar month of January . Just knowing that I planned on writing this berth caused me to be more vigilant in tracking our spending throughout the calendar month .

While we did n’t perfectly stick to our budget , we did n’t completely blow it out of the pee . Good news program , right ? 🙂

Our budget used to be less than $ 1500 per month . Since we ’ve motivate to a more expensive urban center , increase our income , and financed a used car ( gah , I hate even typing that ) , our monthly budget has go up .

NOTE : I do n’t like to deal what our income is . This billet strictly show what I ’ve budget for and what we ended up spending . At the moment , anything special is getting saved towards our next firm . I ’ve left out thing that are automatically take out of paychecks , like insurance and revenue enhancement .

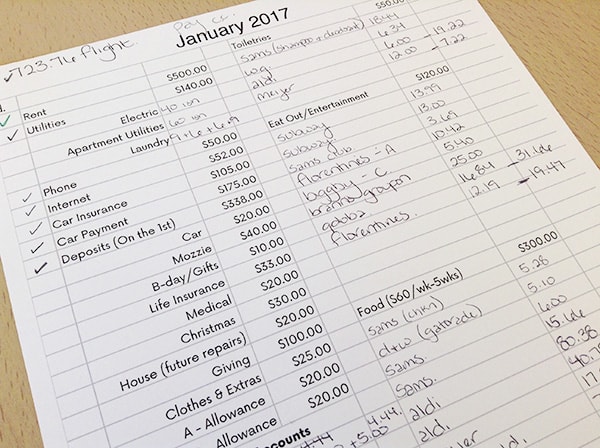

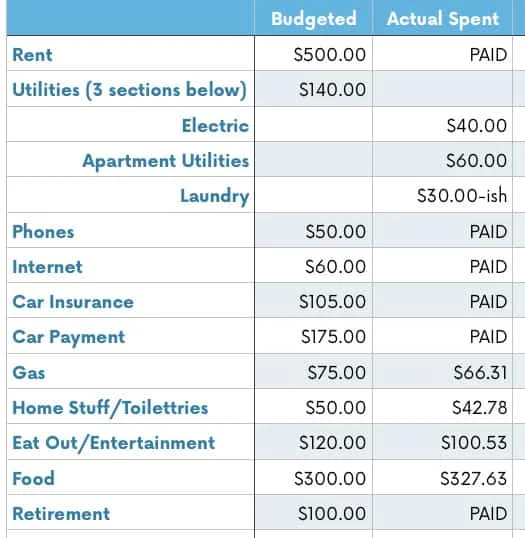

I habituate my special spreadsheet to make our monthly budget and track all of our outgo . you may see my sate out budget form from January below .

you’re able to access my budget spreadsheet and customize it for yourself by enroll your email below :

[ convertkit form=4899234 ]

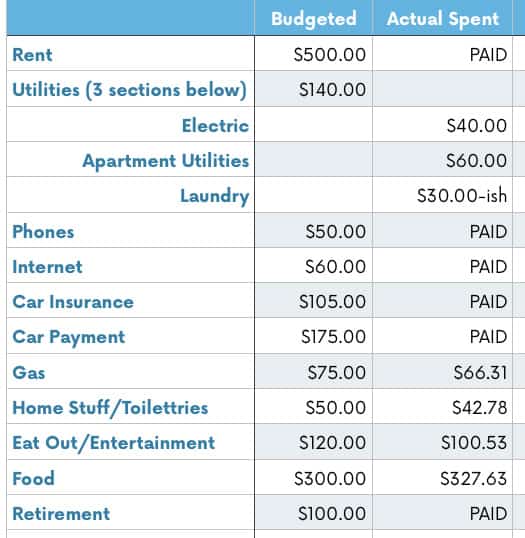

So here are our regular Federal Reserve note and disbursal categories :

We paid all of our peak and did reasonably well on all of the varying class .

We spent a morsel more than we should have on food ( Austin was passing sick at the start of the month and I bought a lot of convenience foods to make life history prosperous ) , but we were under budget on eating out ( thatneverhappens ) and a few other categories , so it all even out out . Pretty exciting !

I ’m still usingIbottato save up money on fruits , vegetable , and store brand items . I also started using Plan to feed part - way through the month to aid me be more designed with my meal provision .

This was our first full month with our new ( used ) car , so I was curious to see what we ’d pass on gas . We drove around a clustering more than normal because we looked at a gross ton of houses all over the metropolis . We still wield to stick around below budget though , so it ’s a profits for the tiny automobile with the good throttle gasoline mileage !

As usual , we bestow money to a bunch of our savings accounts / bury funds . I do this so that our budget appease relatively the same each calendar month . The money just build up in each account until we postulate to drop it .

Below is money that we really drop from our sinking funds . I had enough money saved up in each monetary fund to cover what I spent from it .

I ’ve been saving up off and on for traveling for the past year . This month , we purchased flight to go jaw my parent , so we took most of the money out to pay for that .

Over Budget

The “ Extra Money drop ” discussion section is the things that we buy that were n’t budgeted for . We go $ 75 over budget in January .

Austin and I both had intense neck opening pain in January . Mine literally bring week to go away ( and I still think I require to see a chiropractor ) . I think it was a combination of tension ( plus more stress ) and bad pillows that were mess up us up . We spend about $ 25 each for new pillows which has helped quite a minute ( these ones , in case you ’re curious ) .

The other matter we bought is amini desk . I normally sit on the couch with my laptop computer to work and I mean it was hurt my cervix to look down so much . Also , Mozzie like to sit on my lap while I work , which makes it backbreaking to get things done . I was either having to take a break or posture at tiptop weird angles to use my computer while he sits with me . Yes , he ’s botch . Anyways , the mini desk solves all of those problems .

When we go over budget , I terminate up using money that I would have saved from the next calendar month to pay for the overage .

$ 75 is quite bit to go over budget , but I ’m fine with it since we purchased things that helped our wellness and productivity . We did n’t overspend on frivolous things .

So that ’s my budget review for the month of January ! I think I ’ll in all likelihood do a few budget recaps throughout the year because it really did help me stay on budget knowing that I was going to post our spending .

Related berth :

17 Money Saving Swaps

10 Ways to Stop Impulse Purchases

Our real Budget : Less Than $ 1500 / calendar month

13 Ways to NOT Spend Money