This post may contain affiliate connection . See revealing in the sidebar .

Our massive financial goal for the year is to become debt - free ( again ) . We ’ve been debt - free in the past and alas we had to take on some debt over the past year or so . I ’m very ready to demolish it so that we can have our full income back !

Here ’s the thing : This is an impossible finish . As our income currently stand , it does n’t look like there ’s any way we can make this come about . But that ’s not stopping us !

Between a potential tax coming back , side jobs , and income fluctuations ( blogging is like a roller coaster y’ all ) , we just might make more money than we currently carry .

Plus , and this is crucial , I know that in this circumstancewe’ll get far by propose big than we would if we jell a very easy to achieve destination .

I plan on posting update every few calendar month on how we ’re doing with ‘ missionary station out of the question ’ .

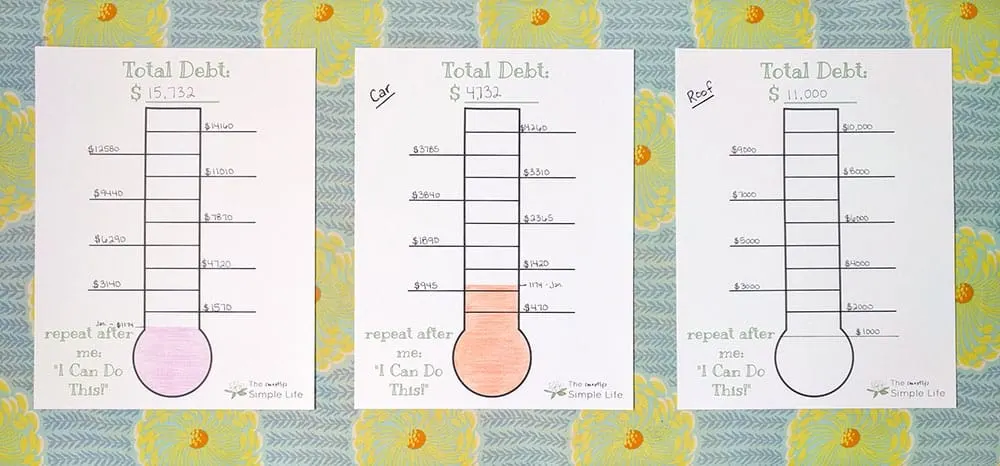

The Debt:

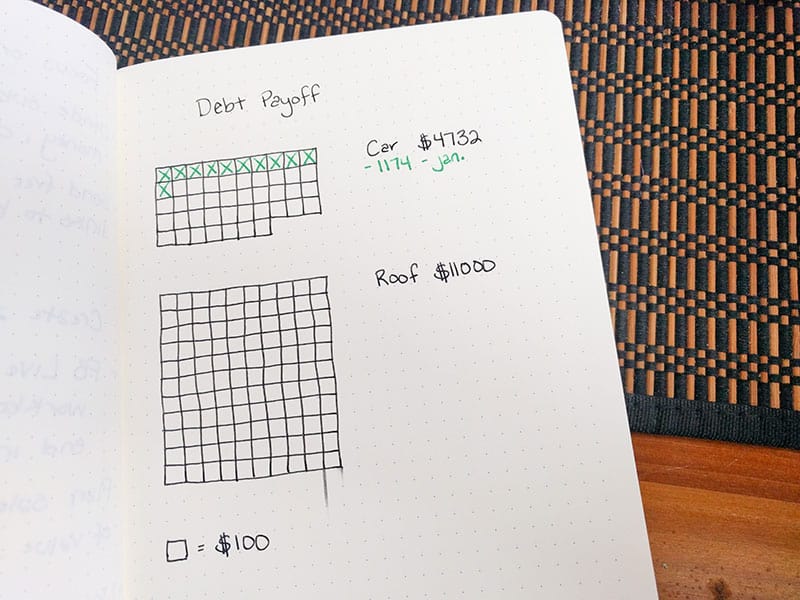

Car: $4732.00

Last winter , our old car was becoming more expensive to restore than it was worth . We traded it in and got a newfangled - to - us piffling car and claim out a loan of a little over $ 8,000 . This was a major bummer since we were completely debt - liberal before this . We ’ve been give extra money at this loan over the past class and have made some decent progress .

Roof: $11,000

We bought a business firm in 2017 that looked like it might want a roof in the next few years . alas , we were n’t able to have the ceiling fully inspected before we shut down because of Charles Percy Snow on it . ( observe to self , never grease one’s palms a theater in the winter . ) It turn out that the roof was actively leak out into a bedroom every clip it rain . We tried patching things , but by fall it was clear-cut that we needed to just replace the whole thing before another winter . My parents we so kind to lend us the money to make it happen and I ’d very - much wish to pay them back ASAP .

Grand Total: $15,732

Ok , typing that was the first time I ’ve really add it all up . I may have had a mini spunk approach … Moving on …

The Plan

We ’re planning on focus all excess money on the cable car loan first to get that out of the way . That will free up some extra income since we wo n’t have a car payment to care about ( ca n’t wait ! ) .

Then we ’ll begin plugging away at the roof loan . $ 11,000 is the large loan we ’ve ever had other than a mortgage , so it ’s looking a short intimidating to me right now .

Dave Ramsey calls this method acting snowballing . You put all extra money toward your smallest loan until it ’s gone . Then you take all of the money you were using against the small loan and put it all towards the next smallest loanword . As you go , your snowball of payments acquire bigger . I recommend his book , The Total Money Makeoverif you want more info or inspiration about paying off debt .

The Problems

I see that I ’m more successful at accomplishing a goal when Ianticipate problemsand adjudicate how I will treat them before they come up . I highly recommend cogitate about what problems you might encounter while you ’re working toward a goal and determine ahead of time what you will do if one comes up .

Here ’s where I anticipate issue :

Progress

I had a bully month in December for my web log ! Plus , I got paid ahead of time for my ads , which was super dainty . I ’m making an excess big car payment for January — Our even payment + $ 1,000 ( ! ! ! ) .

2018 Starting Total: $15,732.00

Current Total: $14,558.00

We ’re tracking our advance on my debt - payoff thermometer . I ’ve got one for each debt , plus a full debt one .

If you want to get my gratis printable debt - payoff thermometer , move into your information below and I ’ll email it to you !

originate Tracking Today !

Powered By ConvertKit

I ca n’t tell you how helpful it is to have a visual way of life to see your forward motion . Years ago , when we were saving so that Austin could go back to school without any loans , I had a saving thermometer and it was so motive . Ca n’t expect to get these totally colourise in !

I also decided to track our progress is theleuchtturm journalmy brother vex me to see which method I care best .

How We’ve Saved Money Recently

With such a big destination , we ’re lick intemperately to bewilder to our budget and spare money wherever potential . you’re able to take a spirit atour $ 2500 per month budget here .

Here ’s what has been assist most lately :

I ’m so excited to get to work on this debt and see if we can be debt - loose by the end of the year !

It would be absolutely awful to get to keep all of our extra income instead of using it to pay up off debt . It has always been our dream to own a mansion on a lake , so we would last be able to save for that !

You Might Like These Wiley Post Too :

How to Have Fun While You ’re give Off Debt

When to Save and When to give Off Debt

How to Live on $ 2500 Per calendar month : Our Actual Budget

How to Spend Less & bring through More

What are your fiscal goals this yr ? Are you saving up for something special or will you be on a debt complimentary journey along with me ?