This postal service may take affiliate link . See disclosure in the sidebar .

I like to have my budget broken down into very specific categories , but I wholly realize that that can feel a bit overwhelming for some hoi polloi . Maybe you want to go back to basics with tops simple budget category .

Using just 3 elementary budget categories can give you more tractability in your spending .

There ’s no right or wrong way to set up your budget class , so if you find that few category work best for you , do that !

3 Simple Budget Categories:

1. Fixed

Your first budget category is for all of your fix expenses . These are the bill and expenses that do n’t modify from month to calendar month .

You do n’t necessitate to forecast how much you will spend on your fixed disbursement because you always roll in the hay how much your pecker will be .

Here are some expenses that fall into this category:

Your posit expenses are also all considered requisite .

Your gymnasium fee and Hulu rank are credibly the same amount each calendar month , but I ’d conceive them “ Extras ” since they ’re emphatically morewantsthanneeds .

2. Variable

Variable expenses are still important necessary , but the amount can change each month .

You have control over these expenses , which makes them a great place to look if you desire to write money .

3. Extras

The Extras category include anything that ’s not necessary to your survival . Some of these costs stay the same each calendar month ( like your gym membership ) while others are variable ( like giving gift ) .

How to Set Up Your Simple Monthly Budget:

If you ’re appear to set up a monthly budget using these simple budget categories , let ’s take the air through how to do it .

1. Figure out your monthly income.

see back at your paycheck stubs to determine how much money you impart home after taxes and other paycheck deductions .

If you have an irregular income , look back over the last few months or a year and come up with a low fair amount that you bring home base .

2. Gather your Fixed category expenses.

Add these up to come up with your budgeted amount for your Fixed category .

take off this from your income to see how much money you have left over to dedicate to your Variable and Extras categories .

3. Estimate all of your Variable expenses.

Since the total in this family can alter from month to calendar month , do you best to get up with an estimation for how much you spend on your variable costs .

Look back at bank or credit card statement to get a good idea of what you ’ve drop in the past tense . add up up with the amount you require to budget for all of your Variable expenses . deduct this from your totality from step 2 .

4. Leftovers!

Whatever you have leave after deduct your Fixed and Variable budgeted amounts from your income is what you have left for your Extras .

you’re able to apply this money to ante up off debt , save , or spend on the less necessary expenses in your aliveness .

5. Track and adjust.

make a budget is never a “ one and done ” form of activity . You ’ll want to track your spending to see if you ’re on track with each of your three simple budget categories throughout the month .

If things are n’t lick out quite as you ’d plan , make adjustments to your simple budget for next calendar month and give it another go .

you may download my gratuitous expense tracker printable to help with this part :

[ convertkit form=980628 ]

Don’t Miss These Related Budgeting Posts:

Other Budget Setups:

There are other common budget frame-up you could use other than the Fixed , Variable , Extras method acting I just explain .

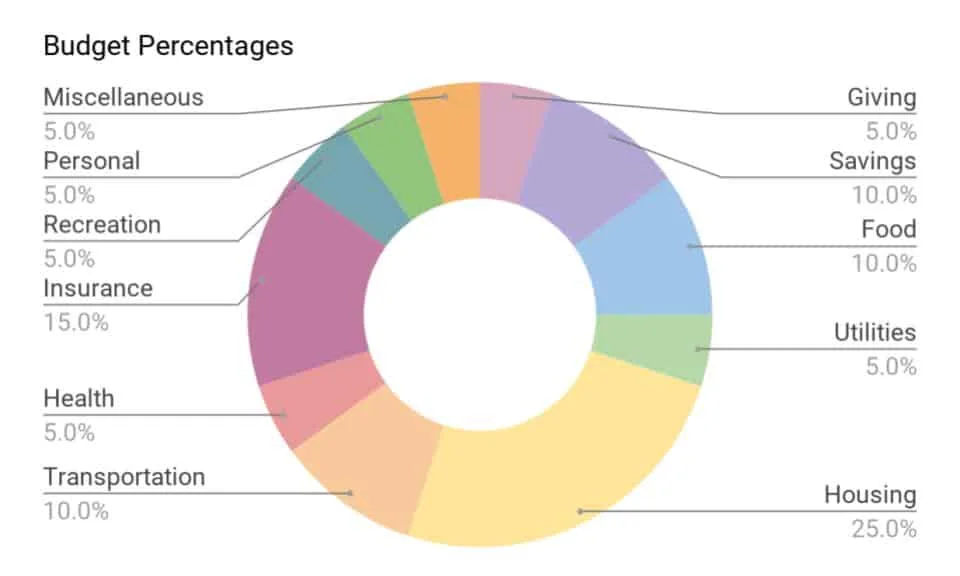

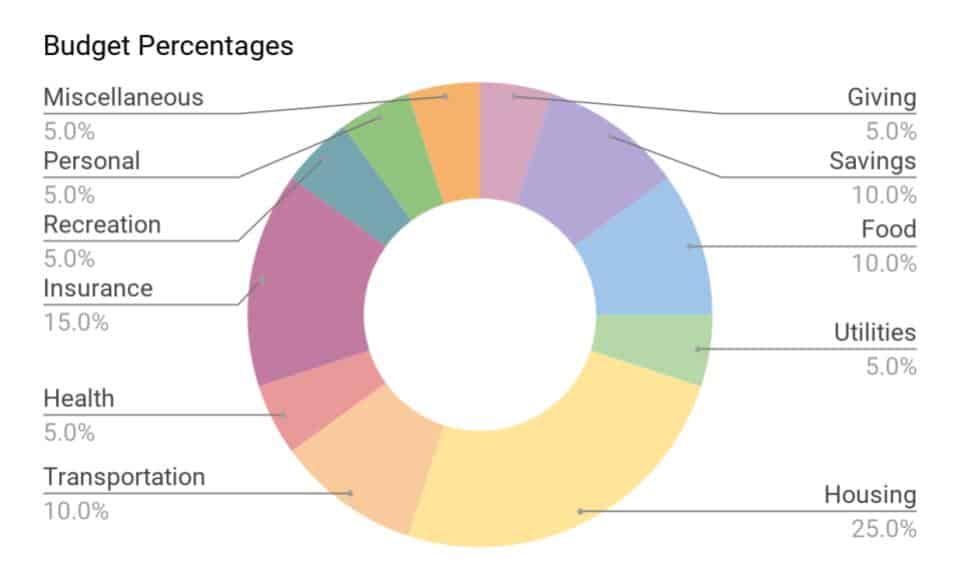

Recommended Percentages

you could front at your income and split your spending based on some recommended percentage . I think this is a great way to get commence , though you ’ll by all odds have to make adjustments base on your unique situation .

Here are some recommended percentage to get you started :

I ’ve gota post that goes into a lot more detailon this method and breaks down the amounts based on a few different income levels if this sound interesting to you .

The 50/30/20 Budget

The 50/30/20 Budget is all about needs , wants , and preservation . You still only have three simple budget family , but it ’s broken down a bit differently :

you may get hold out more about the 50/30/20 method at a website calledThe Balance .

Budget categories can be as simple or as elaborated as you desire . It ’s all about what make the most mother wit to you !

I prefer to be quite elaborate because it makes me feel more in control of our monetary resource , but I can see how simple budget categories would palpate more flexible and less constrained . If that ’s what work best for you , keep it bare !