This post may contain affiliate links . See revealing in the sidebar .

I remember make Austin ’s and my first budget . It was just before our wedding . We were looking at renting an apartment and I was trying to figure out if we could give it .

Austin had just protrude a temp task in a warehouse and I did n’t have a job . To say that money was tight in the first year of our matrimony feel like a drastic understatement .

I sat at my computer switching issue around seek to make thing sour . It was so hard and confusing !

I had no clue how much money we should budget for food and gun for our car . I did n’t make love if the apartment we were looking at was something that we could afford ground on our income .

A lot of advice out there on how to create your first budget says to either ( 1 ) see back at your banking company command for the preceding calendar month to figure out what you drop or ( 2 ) track your spending over the next calendar month so that you know what you are spending in each budget category .

Below is the method that I used to create our first budget . It ended up being a great way to get started and was a degraded path to jump into budgeting .

Step One: Figure Out Your Monthly Income

You need to know how much money you have to act with for your budget . That ’s why image out your income is step number one .

The easiest way to determine your income is to look back at your paycheck stub to see how much money you make after taxes and other payroll check deduction ( wellness insurance , 401(k ) , small fry support … ) .

If you have an unorthodox income that change month to month throughout the year , attempt to look back over a few months and hail up with a humble average .

If you ’re starting a new job , you should be capable to count on your income based on an hourly charge per unit and how many hours you ’ve been told you ’ll be make or a wage . Do n’t forget to seek to reckon your revenue enhancement so you know about dwelling much you ’ll be taking home .

If you ’re estimating income for a new line or an maverick income , it ’s best to be very button-down with your estimate . A lot of people base thing on what should ideally happen , but let ’s confront it , life happen . Things never go completely to plan .

If you estimate a low income and end up making more than expected , that ’s great ! If you overestimate , then you ’re putting yourself at risk of infection for problems to happen .

Once you know what your monthly “ take household ” is ( your payroll check after taxes and other paycheck deduction ) , write that bit at the top of your page .

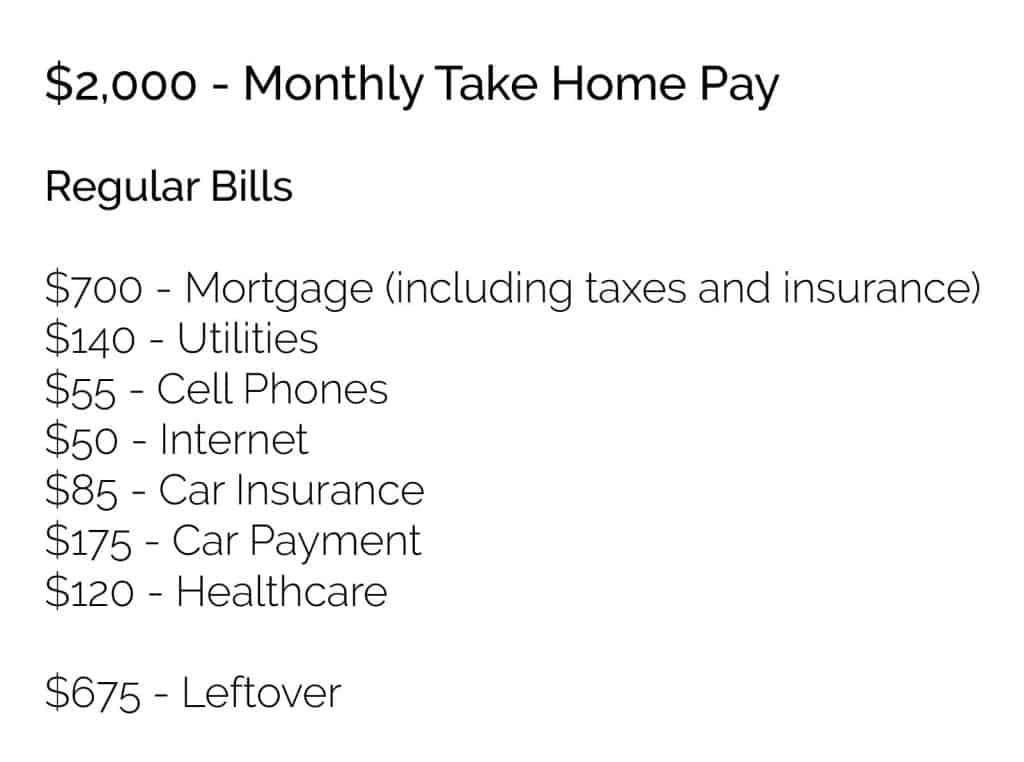

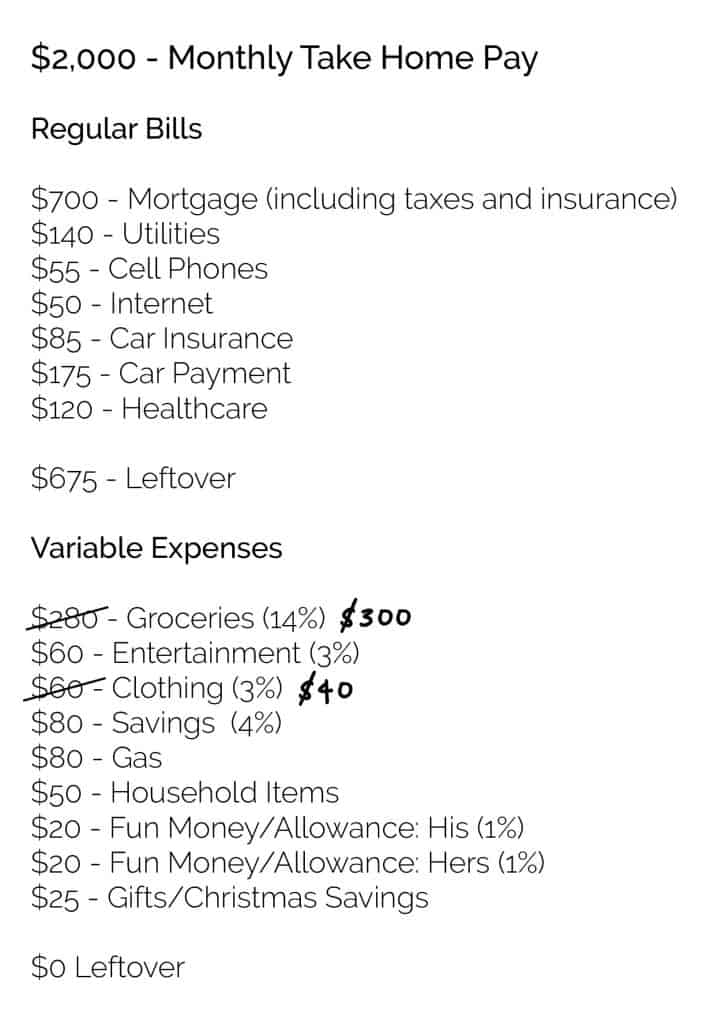

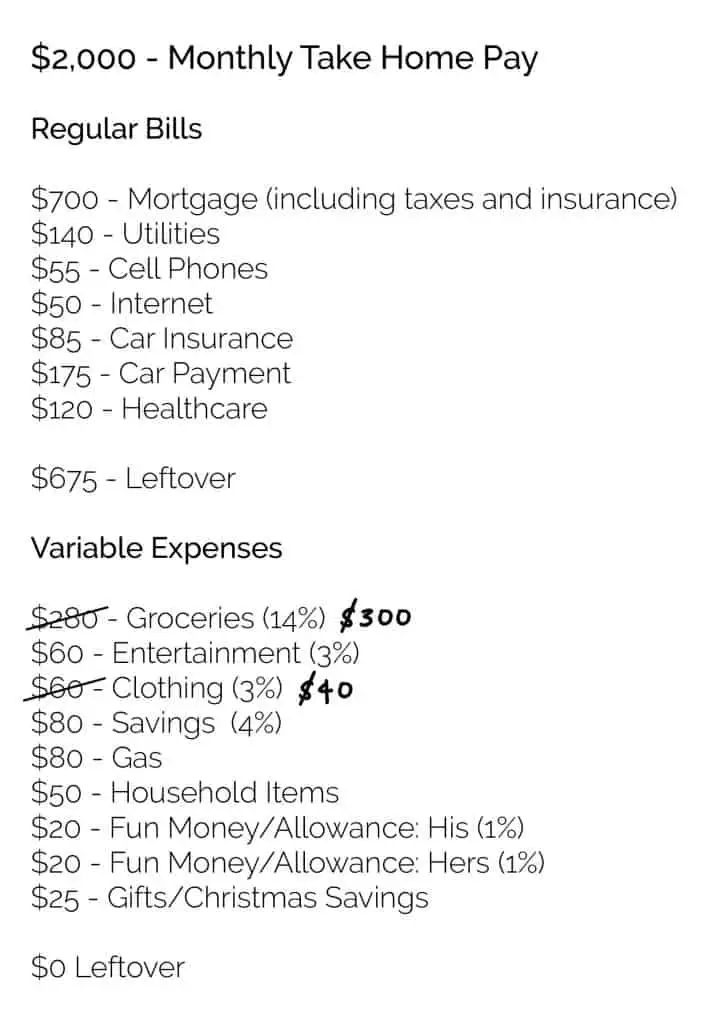

As an lesson , I make a sample distribution budget using a $ 2,000 monthly take base wage :

Step Two: Gather Your Regular Bills

Some card stay the same every month . Look up your statements and write down all of your even bills below your monthly income .

After you ’ve written down all of your regular bills , add them up and subtract that amount from your monthly income . The amount that you have depart is what you have to exercise with for varying expense .

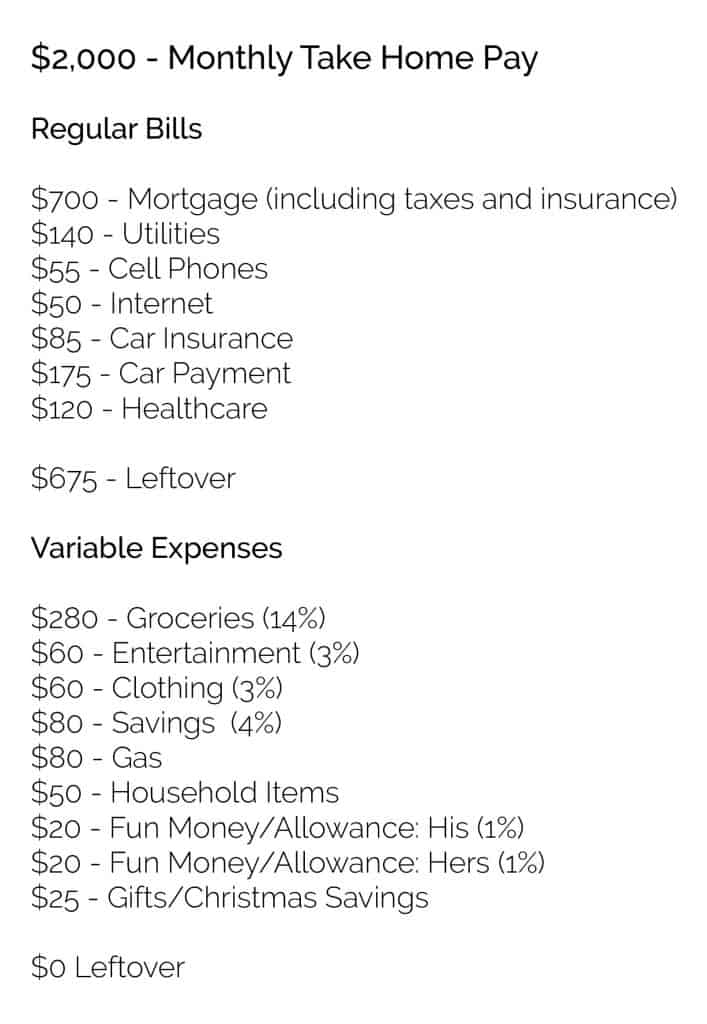

Step Three: Estimate the Rest with Percentages

This is where thing can really get confusing . How much do I spend on market ? Am I going out to exhaust too much ? Do I have money to buy Modern clothes ?

When I made our first budget , I had no melodic theme where to start with “ variable expenses ” , which are disbursal that you have control over .

If you ca n’t search back at late spending and you ca n’t wait a calendar month to see what your spending is , the best affair to do is find some percentages to work with to help you get started .

Crown is one of my favored resources for figuring out budget percentages . They have “ Personal Finance ” resources that will help you estimate expenses based on your income and the size of your kin .

Food : 10 - 15 %

Entertainment : 3 - 9 %

Clothing : 4 - 6 %

Healthcare : 5 - 10 %

Savings : 5 - 10 %

Charitable Giving : 5 - 10 %

Personal / Fun Money : 2 - 5 %

Example : If I bring home $ 2,000 per month , I could estimate that I will spend $ 200 - 300 on food for thought per month ( 10 - 15 % ) .

That ’s just a “ leap off item ” to give you an approximation of what you should be spending . You might spend more or less . We hardly drop anything on wearable , so I do n’t budget 4 - 6 % , but we usually spend a little spear carrier on Entertainment .

Once you have some percentages to work with as a template , you could fine-tune thing from there to decide how you will budget the residuum of your income .

If you take off your varying expenses from what you had leftover after your unconstipated broadsheet , you should end up with zero . This mean that all of your money has been allocated to different category .

Just do the best you could ! This is just a starting point .

Step Four: Track Your Spending

Now that you have a budget made up , you’re able to start using it ! You ’ll want to track your spending throughout the month . There are many outlay tracker apps that you could utilize or you could go with playpen and paper .

The key is to spell down or pass over every dollar that you spend and keep track of what budget class that money work to .

get in your information below to snag my free spending tracker printable :

[ convertkit form=980628 ]

Step Five: Adjust

Since this is your first budget , you in all probability did n’t count on some of your expenses quite right . Maybe you budgeted $ 200 for grocery and you ’ve already spent all of that when you ’re only halfway through the month .

This can be a actual heart unfastener for where you ’re spend your money !

Throughout the month , you may make little adjustments . If you ’re spend more on grocery , then you necessitate to deduct that money from somewhere else , like habiliment or entertainment .

Now that you ’re tag your outlay , you ’ll be able to create a much more precise budget for next calendar month . All of the estimates from whole step three are just a way to get you depart budget quickly . Since you are unequalled and have unlike precedency for your money , your spending and budget wo n’t face precisely like someone else ’s .

Wrapping It Up

you may do this ! If you ’ve never created a budget before or your life has exchange and you do n’t know where to start , adopt the steps in this guide to help you quickly create your first budget .

Our first budget was n’t thoroughgoing . It took me a few month of budgeting to get it figured out , but getting lead off and working at budgeting will get you much further financially than not trying at all .

tick out the related posts below or take in all mypersonal budgetingresources and advice to aid you create your first budget .

Related Posts :

Our Actual Budget : know on Less Than $ 1500 / Month

13 Secrets to Saving Money on Food ( while eat healthy )

The Huge Financial Benefit of Staying Home