This post may contain affiliate links . See disclosure in the sidebar .

We ’re totally a spot old fashion in the means that we track our spending and bill payments .

There is a massive motley of apps and programs uncommitted that can help oneself you tail your spending and they work really well for lots of the great unwashed . And if that works for you , I ’m all for it !

![]()

I roll in the hay a lot of people lie with using theMint , Spending Tracker , andMvelopesapps .

Personal finance is personal ! Which mean what works best for you might not be the best thing for me .

I ’ve already shared with you a close - up expect atour genuine budget . Now I ’m snuff it to share how we keep racetrack of the money we spend and the bills we require to give .

- Update : See our current $ 2500 / calendar month budget here

I’m Not Comfortable With The Access They Have To Accounts

Most budgeting apps and apps that chase after your outlay need access to your write up .

They can see all of your charges on various credit and debit entry cards so that they can severalise you where you ’ve been drop your money . Some even demand access to investment funds and mortgage invoice .

I ’m not at all prosperous with an app throw admittance to any of my accounts , countenance alone all of them .

I Like To Divide Purchases Into Multiple Categories

To help keep on top of our blind drunk budget , I fraction our spending into multiple category .

I separate groceries from thing like shampoo and shabu bags .

Apps that track your expenditure only see that I made a purchase at Walmart . They do n’t see that I bribe items that should be divided up into dissimilar spending class .

My Solution: One Spreadsheet to Rule Them All

You experience I like to keep things simple .

I have created a spreadsheet that I utilise to tag all of our spending . It also reminds me of what bills I call for to give . Andit ’s all on one part of paper . Easy - peasy .

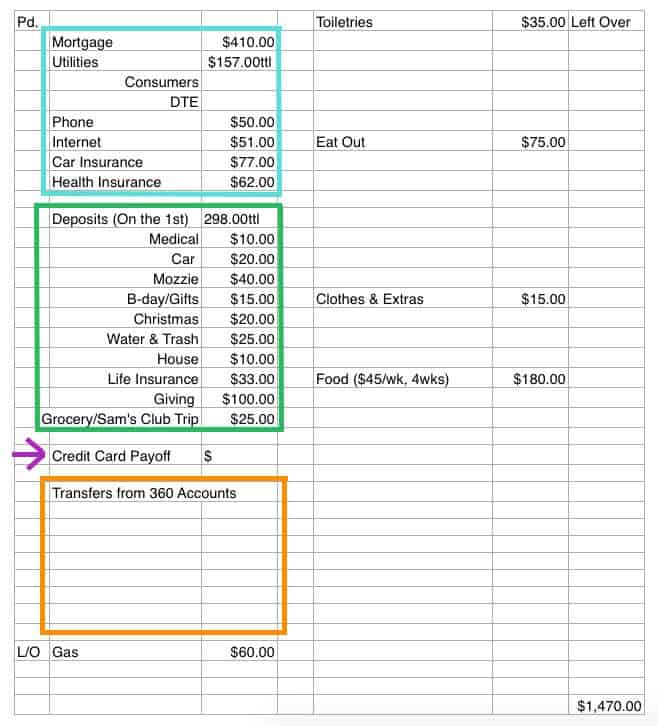

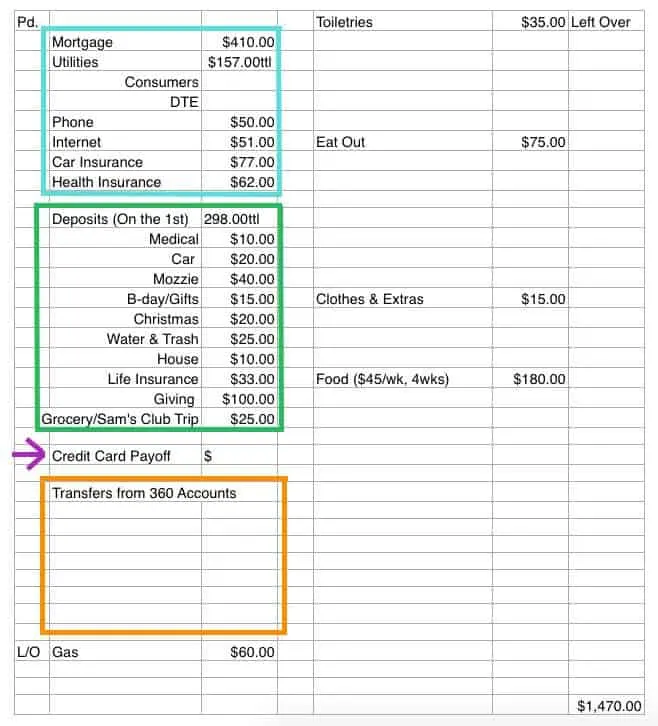

TheBlueBox

This is where I list our regular monthly bills : our mortgage , utility , phone , internet , and insurance bank bill .

In the left-hand - manus “ paid ” column , I leave a arrest mark when that bill has been paid , either by me or through an automatic defrayment .

This puzzle out well as a monitor of all of our unconstipated bill that need payment .

TheGreenBox

The green box shows all of our monthly automatic deposits .

This ishow we save for irregular banknote and expenses .

On the first of the calendar month , money is take from our checking account and placed into single savings fund for categories like Christmas , car fixing , and our quarterly water and wish-wash bill .

I leave this incision on our budget as a reminder of where a big chunk of our money is going . I ’ll chink off the “ compensate ” box on the left when the deposit have gone through .

I extremely recommend usingCapital One 360savings account .

They allow you to have up to 25 separate savings accounts . you may dub your accounts to correspond with your choose category and have money mechanically fix to the account as regularly as you want .

I plan our budget monthly , so I have money automatically added to our account on the first of every month .

I have used Capital One 360 for many year now and these savings account have helped our budget vastly . Plus , they give you a .75 % interest rate which is way undecomposed than our veritable camber .

ThePurpleArrow

We make up off our course credit batting order in full every calendar month .

I put it on my budget as a reminder that the flyer take to be pay . I ’ll write in the amount that I pay off when I make this defrayment .

TheOrangeBox

Throughout the calendar month , when we expend money that needs to come from one of our mini savings funds ( like buy a birthday present or take Mozzie to the vet ) , I write down what I necessitate to transfer .

So , I ’ll write down that I need to transplant $ 30 from our cable car investment firm to our regular check report to pay for an oil change .

Or I ’ll channel $ 75 from our “ water and shabu ” savings accounting when I get our bill from the city .

Related Wiley Post :

Our genuine Budget : Living on Less Than $ 1500 / Month

13 secret to economize Money on Food ( while eating tidy )

The Huge Financial Benefit of Staying habitation

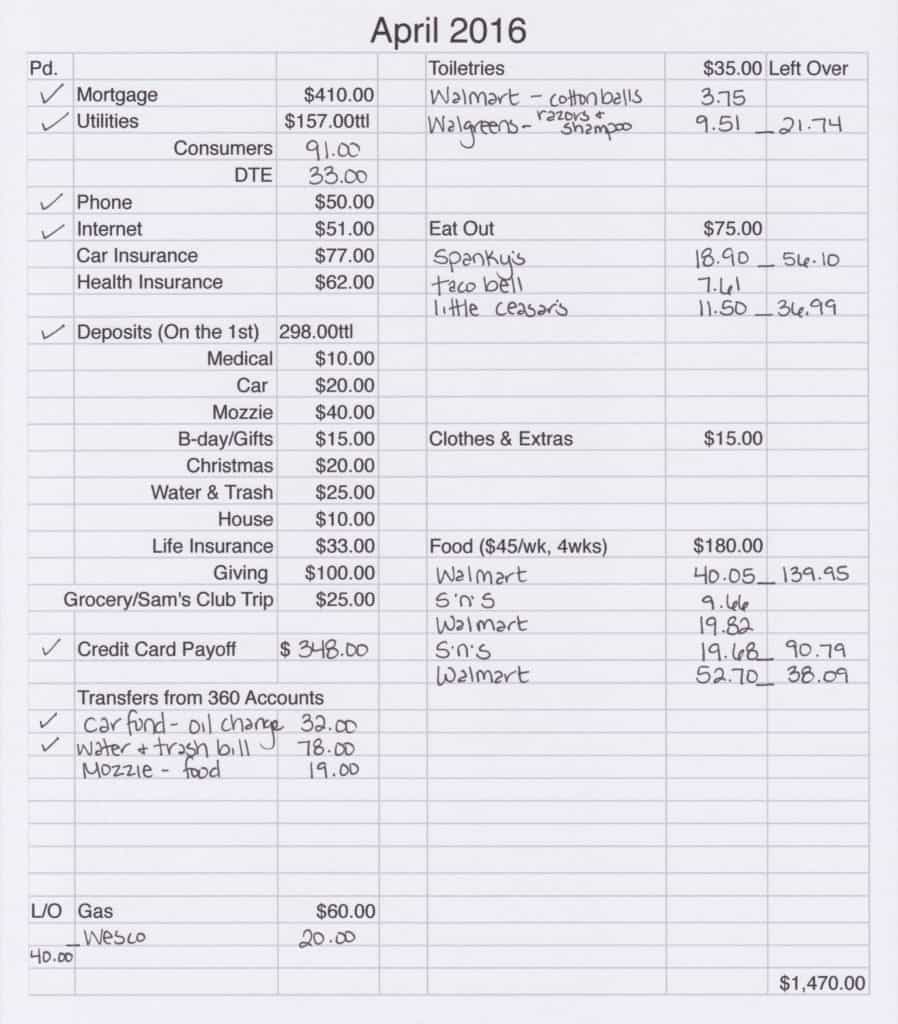

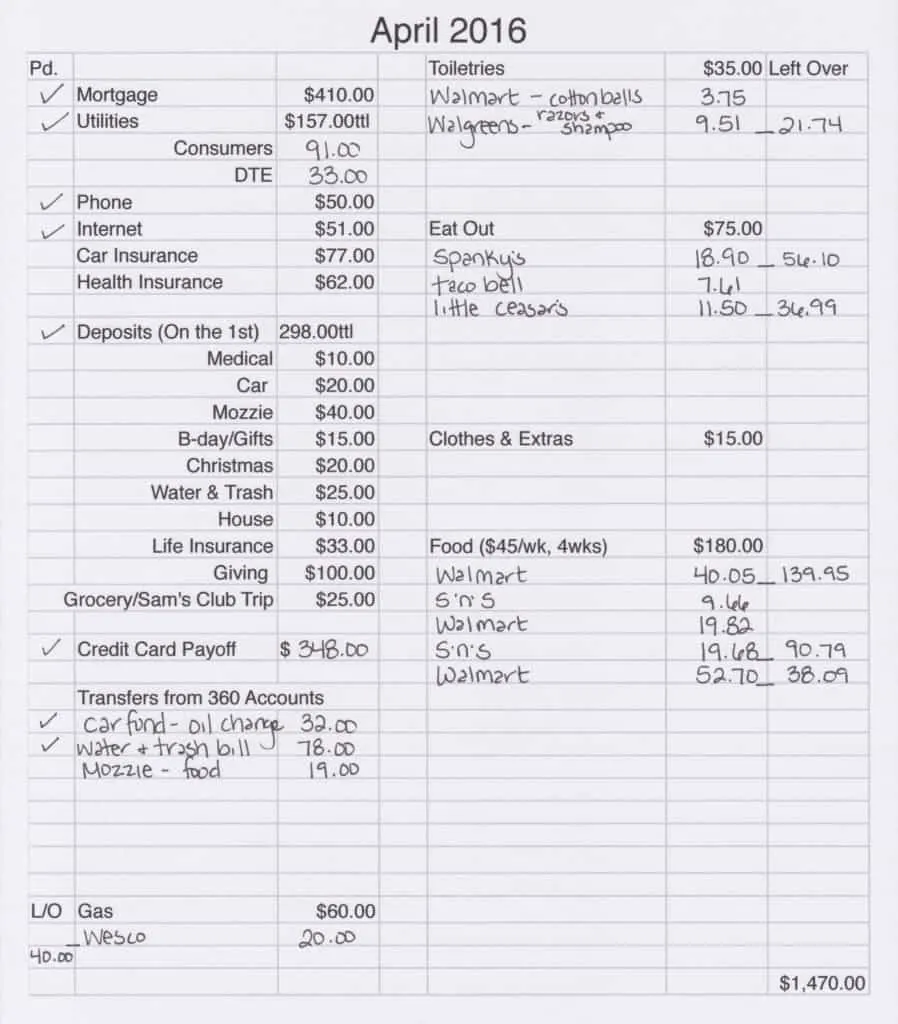

The sleep of my spreadsheet show my budget category for gas , toiletries , eat out , extra , and foodstuff .

Whenever we make a purchase , I check that that we get a reception . When I get home , I take two minutes to register what we spent under the proper class .

Sometimes I ’ll divide up a leverage into multiple categories .

Example : We spent $ 70 at Walmart . $ 10 of it was for stuff for Mozzie , so I write down that I need to transfer money out of his savings account and back into checking . $ 40 was for groceries , so I mark that in the grocery pillar . $ 20 was spent on shampoo , toilet paper , shabu bags , and mascara , so I mark that amount under the toilet articles incision .

Here ’s what my filled in budget spreadsheet looks like about midway through the month :

When my married man shops or stops for gas , he know to grab a receipt and give it to me . If he block or ca n’t get one , I ’ll just expect him what he spend money on when I look at our write up online .

It ’s a really simple system that has work well for us for year . It only takes about 5 minute to maintain each week and we know exactly where we ’re at with our spending all the time .

A few days before the next month , I ’ll open up my budget spreadsheet and exchange any numbers that I want to , like if there are 5 week in the month alternatively of 4 , I ’ll up our grocery budget amount .

I print out my spreadsheet and keep it with my“binder of important things”in the kitchen where I ’m most potential to call up to memorialise my receipts .

Why A Simple Budget Spreadsheet Is Awesome:

unexampled !

you may now download my free printable expense tracker ! Customize it to fit your need and track your spending :

[ convertkit form=4899234 ]

13 Ways to NOT Spend Money

My Favorite Part of Our Finances : The Emergency Fund

The 5 big Ways We lay aside Big Money